Company Update : Federal Bank Ltd By Motilal Oswal Financial Services Ltd

.jpg)

PPoP in line; high provisions lead to earnings miss

Business growth muted

* Federal Bank reported 3QFY25 PAT of INR9.55b (down 5% YoY), 7% below our estimate due to increased provisions.

* NII grew 14.5% YoY to INR24.3b (in line). NIMs stood largely flat at 3.11% (down 1bp QoQ).

* Other income grew 6% YoY to INR9.16b (down 5% QoQ, in line).

* Total revenue rose 12% YoY (in line). Opex grew 15% YoY (2% lower than MOFSLe).

* PPoP thus grew 9% YoY to INR15.7b (in line).

* Provisions jumped 220% YoY/85% QoQ to INR2.9b (68% higher vs. MOFSLe).

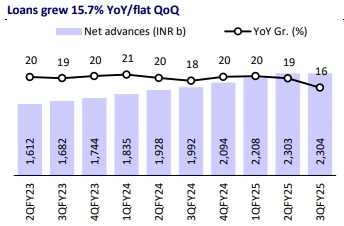

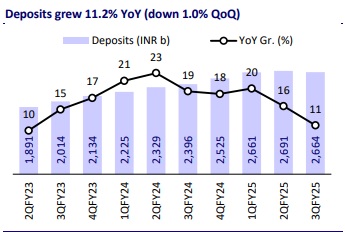

* Loan growth was flat, whereas deposits declined 1% QoQ. As a result, total business inched lower by 0.5% QoQ (up 13% YoY).

* GNPA ratio improved 14bp QoQ to 1.95%, while net NPA ratio improved 8bp QoQ to 0.49%. Increased provisions led to a jump in PCR ratio to ~75% (up 2.2% QoQ).

* Slippages increased to INR4.98b (INR4.34b in 2QFY25).

* RoA stood at 1.14% annualized, while RoE was 12%.

* Tier-1 stood at 13.78% vs. 13.82% in 2QFY25.

* Valuation and view:

Federal Bank reported a weak quarter as the bank made higher-than-expected provisions, while business growth remained weak. NIMs stood largely flat (down 1bp QoQ) at 3.11%. Loan growth was flat QoQ, while deposits declined 1% QoQ. CASA stood at 30.2%. On the asset quality front, slippages increased 14.7% QoQ. Healthy recoveries and upgrades led to a 14bp QoQ reduction in GNPA ratio to 1.95%, while NNPA declined 8bp QoQ to 0.5%. The earnings call is scheduled for 28th Jan’25 at 8.30am IST.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412