Commodity Morning Insights 02 December 2025 - Axis Securities

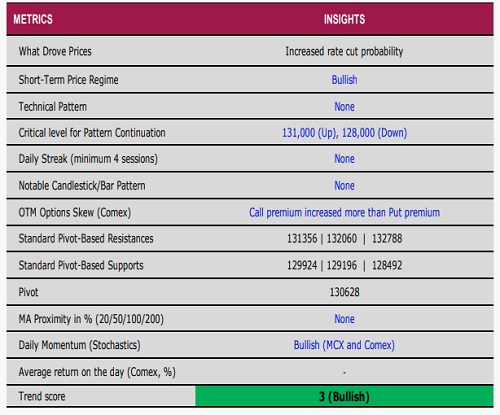

* Comex Gold climbed more than 2% as expectations of a December ’25 rate cut strengthened following better-than-expected U.S. data. Prices have moved back toward a one-month high, supported by steady central bank purchases and strong non-sovereign ETF inflows. The combination of persistent demand and declining real yields continues to underpin what could be gold’s strongest annual performance since 1979

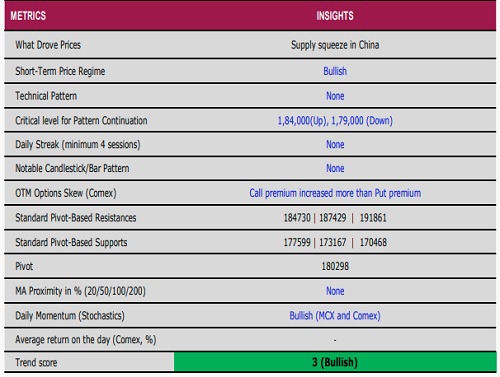

* Comex Silver extended its winning streak for the fifth consecutive session, gaining nearly 3% and marking a fresh 52-week high at $58.84. Improved rate-cut odds and a sharp drop in inventories at SHFE-linked warehouses—now near decade-low levels—have reinforced the positive bias at lower levels

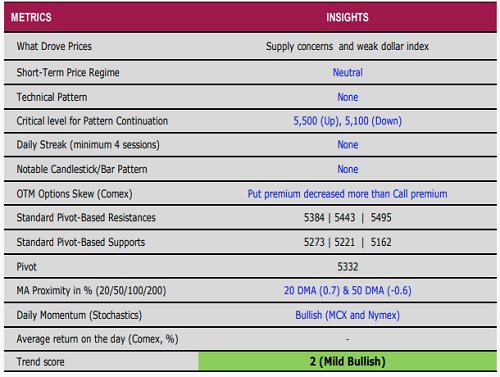

* Nymex Crude Oil advanced close to 2% in the previous session, buoyed by a weaker dollar and reduced Russian exports after Ukrainian drone strikes. The broader setup remains constructive, with prices expected to hold a positive bias as long as the $55 support zone remains intact

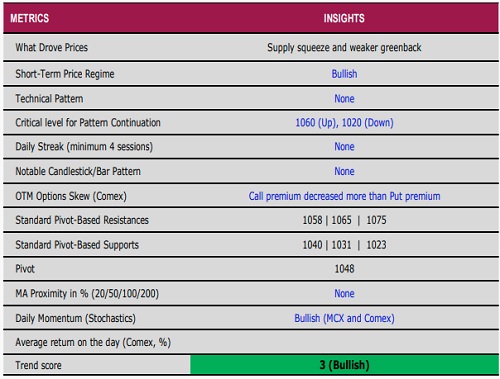

* Copper futures ended the session little changed after touching a multi-week high. Tightening supply conditions are becoming increasingly evident, leaving the metal highly sensitive to fresh bullish cues. The underlying tone stays positive as long as the supply backdrop remains constrained.

GOLD

SILVER

CRUDE OIL

COPPER

For More Axis Securities Disclaimer https://simplehai.axisdirect.in/disclaimer-home

SEBI Registration number is INZ000161633