China`s Curbs on Rare Earth Elements; Jolts Indian Auto Sector into Action by CareEdge Ratings

Synopsis

* In April 2025, China imposed stringent export controls on seven rare earth elements (REEs) commonly used in producing high-performance magnets, disrupting global supply chains. India, which relies heavily on Chinese REE imports, faces potential production curtailment across the automotive sector with the gradual depletion of older inventory.

* China controls 70% of REE production and 90% of processing. Delays in REE shipments for Indian auto OEMs may impact electric, Internal Combustion Engine (ICE) and hybrid vehicle production starting in July 2025, particularly higher-end models that depend on REE-based technologies. Automakers might need to shift focus to mid-range or base models to address supply disruption. However, China’s recent decision to temporarily allow REE exports to top U.S. automakers offers hope for resolving the impasse for Indian companies as well.

* Apart from pursuing China through diplomatic channels, India is also considering the commercialisation of magnet manufacturing technologies currently held by select public-sector entities, and exploring alternative suppliers like Vietnam, Australia, and the U.S. However, these sources currently lack sufficient processing capacity.

* In the short term, Indian automakers are expected to resort to importing fully assembled components and sub-systems from China to mitigate the rare earth magnet shortage. This tactical shift aims to maintain production continuity while domestic and alternative sourcing strategies are being developed.

* In the medium to long term, India aims to build a self-reliant REE ecosystem through domestic exploration, private sector incentives, R&D in REE alternatives, and strategic international partnerships.

Auto Industry Faces New Supply Chain Strain Amid China’s REE Export Curbs

The Indian automotive sector is confronting a fresh wave of supply chain disruptions, after grappling with the semiconductor shortage and pandemic-era challenges a few years back. On April 4, 2025, China introduced stringent export controls on seven rare earth elements (REEs), namely Neodymium, Dysprosium, Terbium, Samarium, Gadolinium, Praseodymium and Cerium, commonly used in the production of high-performance magnets critical to the automotive, defence, clean energy, aerospace and electronics industries. Under the new regulations, Chinese exporters must secure special licenses, end-user certificates, and government-to-government approvals to ship these materials abroad.

This move is widely seen as a strategic response to heightened tariffs imposed by the U.S. on Chinese imports. China currently dominates the global REE market, accounting for 70% of total production and nearly 90% of processing capacity. Although REEs are relatively abundant in the Earth’s crust, they are rarely found in concentrations that are economically viable to extract. China’s dominance stems from decades of targeted investments, lenient environmental regulations, and robust state-backed industrial policies.

The impact of these restrictions is expected to ripple across electric, ICE and hybrid vehicles. REEs are essential in various automotive components, including electric motors, battery management systems, catalytic converters, infotainment systems, power steering, brake-by-wire systems, and advanced safety sensors. As a result, the disruption is not limited to electric vehicles (EVs) but extends to ICE & hybrid models. While REE-based components are utilised in traditional ICE vehicles, the production of EVs is fundamentally reliant on them—without REEs, manufacturing an EV is virtually impossible.

Higher-end vehicle variants incorporating more REE-dependent technologies will likely be affected first. In response, OEMs may shift focus towards producing mid-range or base models to mitigate the impact of the supply constraints. In the short term, Indian automakers are expected to resort to importing fully assembled components and subsystems to mitigate the rare earth magnet shortage in case of a delay in obtaining licenses/approvals from China for importing REE. While this may offer a temporary reprieve, it is likely to increase input costs due to higher import duties, logistics expenses, and currency fluctuations. This tactical shift aims to maintain production continuity while domestic and alternative sourcing strategies are being developed.

EV Growth Momentum May Face Headwinds

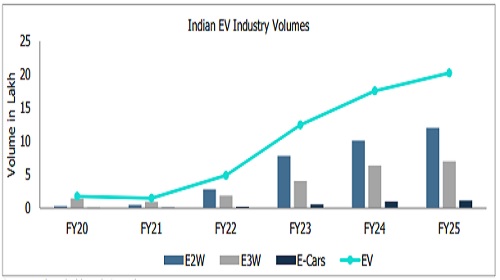

The demand for EVs in India has been primarily fuelled by a shift in consumer preference towards mobility solutions that offer lower fuel costs, reduced maintenance, and fewer servicing requirements, resulting in a comparable total cost of ownership (TCO) to ICE models. Over the five years ended FY25, EV sales surged to approximately 2.03 million units, registering a compounded annual growth rate (CAGR) of 63%. This growth has been significantly bolstered by the electric two-wheeler (E2W) segment, which grew at a CAGR of 112%, driven by affordability, ease of use, and favourable policy incentives.

However, this robust growth trajectory now faces a roadblock due to the shortage of REE, critical elements used to make high-performance magnets used in EV motors and battery management systems. China’s recent export restrictions on REEs have disrupted global supply chains, delaying shipments and creating uncertainty for Indian automakers.CareEdge Ratings believes that the Indian government’s proactive engagement, combined with industry adaptability, is expected to ensure continuity in the long term. However, a prolonged shortage could significantly derail production schedules across the automotive value chain. The impact would not be limited to OEMs but would also ripple through the auto component ecosystem, particularly those manufacturing electric motors, battery management systems, catalytic converters, infotainment systems, power steering units, brake-by-wire systems, and advanced safety sensors. This underscores the urgent need for a resilient and diversified supply chain, supported by domestic capability building and global partnerships.

India’s REE Supply Chain at Risk: Addressing Today’s Crisis, Building Tomorrow’s Capacity

Shipments of critical REE-based components from China have slowed significantly due to newly imposed export licensing requirements. Under the revised framework, Chinese exporters must disclose detailed end-user information, which is subject to verification by Chinese authorities before any shipment is approved. This verification process has led to considerable delays.

As of June 2025, none of the export license applications submitted by Indian firms for REEs have been approved by China, despite sustained diplomatic efforts. With inventories depleting, major OEMs warn of potential production disruptions starting July 2025. The situation highlights India’s heavy reliance on Chinese REEs and the absence of domestic processing capacity. Rising input costs and supply uncertainty could slow EV adoption and expose the auto sector to broader geopolitical risks.

In response, Indian stakeholders actively advocate for diplomatic engagement with China to expedite pending approvals, streamline licensing procedures and ensure the uninterrupted flow of critical components. The government is considering commercialising magnet manufacturing technologies currently held by select public sector entities as an immediate contingency measure. Simultaneously, efforts are underway to formalise alternative supply chains for REEs, with potential sourcing from countries such as Vietnam, Australia and the U.S. However, these alternative sources lack the processing capacity to meet global demand soon.

To build long-term resilience, India must accelerate the development of a domestic REE supply chain. This includes exploring REE-rich regions, incentivising private sector participation in mining and processing, investing in R&D for alternative technologies, and forging global partnerships. India’s import dependency on China for rare earth permanent magnet remained as high as 90% during FY24 & FY25. This extreme dependence highlights the urgent need for strategic investment in refining infrastructure to achieve technological self-reliance.

CareEdge Ratings’ View

"India’s rare earth element crisis is not merely a supply chain disruption but a strategic wake-up call. The bottleneck created by China’s export licensing regime has exposed the fragility of India’s EV ambitions, with inventories depleting and approvals stalled. This crisis underscores the perils of over-dependence on a single geopolitical actor for critical inputs. The path to resilience lies in building a full-spectrum domestic REE ecosystem. Strategic reserves, public-private R&D, and global partnerships must converge into a coherent national strategy," said Madhusudhan Goswami, Assistant Director, CareEdge Ratings.

"China’s April 2025 export restrictions on REEs, which account for 70% of global production and 90% of processing, have disrupted global auto supply chains. India imported nearly 90% of its permanent magnets containing REEs from China during FY24 & FY25. The shortage threatens the production of EV, high-end ICE and hybrid vehicles starting in July 2025. Accordingly, timely resolution of the matter would be of utmost importance, especially for the Indian automotive sector in FY26,” said Arti Roy, Associate Director, CareEdge Ratings.

Above views are of the author and not of the website kindly read disclaimer

.jpg)