Capital Market : Stable market environment By Motilal Oswal Financial Services Ltd

Stable market environment

Option premium dips, cash inches up; MAAUM nearing the INR75t mark

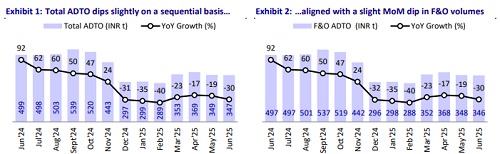

* In Jun’25, total ADTO was largely flat MoM at INR347t. While cash activity continues to grow (ADTO up 2% MoM) amid positive market sentiment, F&O activity was broadly flat (ADTO down 1%).

* Retail participation witnessed a MoM decline across segments, with retail cash ADTO declining 1% MoM to INR74b after witnessing a strong surge last month, and retail futures and options premium ADTO declining 10% MoM to INR606b.

* The commodity market achieved a new peak backed by crude volatility and rising prices of precious metals, with volumes growing MoM across key commodities and ADTO rising to INR3.4t in Jun’25 (+25% MoM).

* Demat additions inched up MoM to 2.5m in Jun’25 (2.2m in May’25). IPO activity continues to recover with a strong pipeline going forward. (Five IPOs in Jun’25).

* MF MAAUM grew ~4% MoM in Jun’25 to INR74.8t (up 22% YoY), with equity AUM achieving a new peak at INR32.7t (+4% MoM). SIP flows hit a new high of INR273b (INR267b in May’25).

* The industry posted continued MoM growth in cash volumes, while premium turnover sharply declined MoM. Growth in equity inflows amid positive market sentiments led to maintained momentum for MF AUM. An increase in volatility due to geopolitical pressures led to a strong rise in commodity volumes. We expect that a stable growth trajectory for volumes and rising retail participation should support the performance of market intermediaries. However, further tightening of F&O regulations, if any, is a key concern in the short term. Strong MF flows and continued SIP trajectory will bode well for AMCs. Our sectoral top picks are Nuvama, HDFCAMC, and UTIAMC.

Equity: Market activity broadly stable MoM

* Total ADTO declined 1% MoM in Jun’25 to INR347t, with F&O ADTO declining 1% MoM to INR346t and cash ADTO growing 2% MoM to INR1.2t. The option premium ADTO declined 17% MoM to INR630b.

* In the cash segment, NSE retained its dominant position with a 93% market share in Jun’25, while BSE’s market share inched up MoM to 7%. In F&O, BSE’s market share inched up MoM in terms of notional turnover to 37.2% (36.7% in May’25), while premium turnover market share grew to 22% (21.1% in May’25)

Commodities: Volumes surge, reaching a new high

* Total volumes on MCX grew 19% MoM to INR71.3t in Jun’25 (up 95% YoY), with ADTO at ~INR3.4t – beating the old peak of INR3.2t (Apr’25). Option volumes grew 22% MoM to INR62.8t, while futures volumes grew 1% MoM to INR8.5t.

* The strong growth in options ADTO was largely due to ~6x MoM surge in silver ADTO, along with 7%/29%/9% MoM growth in gold/crude oil/natural gas ADTO. Option premium grew 14% MoM to INR937b, reflecting a premium to notional turnover ratio of ~1.6%.

* In commodity futures, ADTO’s flattish performance was owing to a 13% MoM decline in gold futures ADTO offset by 4%/46%/81%/9% MoM decline in copper/silver/crude oil/natural gas futures ADTO.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

More News

Nifty immediate support is at 25100 then 25000 zones while resistance at 25350 then 25500 zo...