Buy V-Mart Retail Ltd. For Target Rs.2,617 By Centrum Broking

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

V-Mart’s Q3FY24 print was in-line to our expectations; revenue/EBITDA/PAT grew 14.4%/15.4%/ 41.3%. We believe sharp price cuts effected in V-Mart/Unlimited franchise helped to, (1) 23% growth in footfall, (2) SSSG at 4% and (3) 34% contribution from new buyers. V-Mart/Unlimited revenue grew by 13%/12%, yet Limeroad saw 2.3x jump in revenues at Rs170mn, V-Mart/ Unlimited ASP cut by 5%/10% driving faster growth in T1/T4 markets at 7%/12% yet cut by 5% in T3 (high base). Management expects demand to pick up gradually given, (1) pricing action to attract value seeking customers driving store footfalls, (2) lowering food inflation, (3) govt. push to lift rural income, and (4) building customer traffic for Limeroad. Gross/EBITDA margins grew to 35.5% (+9bp) and 13.5% (+12bp) led by higher employee/other expenditure at +1.1%/+24.9%. Management appears to be confident of turnaround in Limeroad and achieve break-even in FY25E. With strong performance we tweak our earnings and maintain BUY with a revised TP Rs2,617 (EV/EBITDA of 15.5x avg. of FY25E/FY26E).

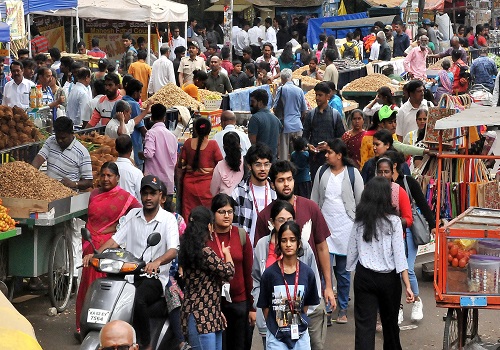

Sharp price cuts driving footfall for value seeking customers

V-Mart’s Q3FY24 print was in-line to our expectations; revenue/EBITDA/PAT grew 14.4%/15.4%/ 41.3%. We believe sharp price cuts effected in V-Mart/Unlimited franchise helped to, (1) 23% growth in footfall, (2) SSSG at 4% and (3) 34% contribution from new buyers. V-Mart/Unlimited revenue grew by 13%/12%, yet Limeroad saw 2.3x jump in revenues at Rs170mn, V-Mart/Unlimited ASP cut by 5%/10% driving faster growth in T1/T4 markets at 7%/12% yet cut by 5% in T3 (high base). Management expects demand to pick up gradually given, (1) pricing action to attract value seeking customers diving store footfall, (2) lowering food inflation, (3) govt. push to lift rural income, and (4) building customer traffic for Limeroad. Management said though high food inflation cut consumer sentiments impacting value-fashion demand there is a gradual recovery seen during high festive and wedding season. Company added 16/4 V-Mart/Unlimited stores in Q3 taking store count to 454 spread over 263 cities, yet closed 3 non performing stores and guided for addition of 40-45 in FY25. V-Mart is confident to turnaround Limeroad business with strong focus on profitability indicates business to break-even by FY25.

Focus on volume growth, efficiency, throughput and scale up in Unlimited to lift margins

Gross margins grew to 35.5% (+9bp) YoY on account of lower cotton yarn prices. Despite higher employee cost (+1.1%) and other expenses (+24.9%) EBITDA grew 15.4% settling EBITDA margin at 13.5% (+12bp). Further Limeroad losses cut by 36% to Rs141mn. Management said margins to improve given, (1) sharp correction in cotton/yarn prices, (2) higher ticket size for winter merchandise shifted to Jan’24, (3) improved throughput and efficiencies, (4) commercialized operation at new warehouse, and (5) mix change directed by strong winter this time. We believe focus on driving footfall and turnaround in Limeroad would help V-Mart to sustain gross margins at ~35%, while sharp focus on contribution margin and profitability for Limeroad could influence EBITA in our view.

Lean balance sheet provides comfort; valuations remain attractive

We reckon stores in T1 (urban) and T4 (deep rural) performed better, yet higher food and fuel inflation hit sales in T3 markets (high store base). However, sharp pricing actions to attract value seeking customer appears to be right move which helped to improve footfall and drive volumes in our view. We believe V-Mart’s core markets are expected to revive given improved macros and store closures in Unlimited may lift SSSG driving better performance ahead. We believe, Limeroad acquisition to add value to digital first customers by providing value through Omni-channel strategy. With improved 9MFY24 we cut PAT loss of Rs530mn in FY24E, and increase earning for FY25E by 51%. We maintain BUY with a revised TP Rs2,617 (EV/EBITDA of 15.5x avg. of FY25E/FY26E) as stock is now trading -2 Std. Deviation. Key risks – slowdown in top-line, longer breakeven in new stores and competition.

For More Centrum Broking Disclaimer https://www.centrumbroking.com/disclaimer/

SEBI Registration No.:- INZ000205331