Buy UPL Ltd For Target Rs.771 - Centrum Broking Ltd

Global agrochem headwinds persist

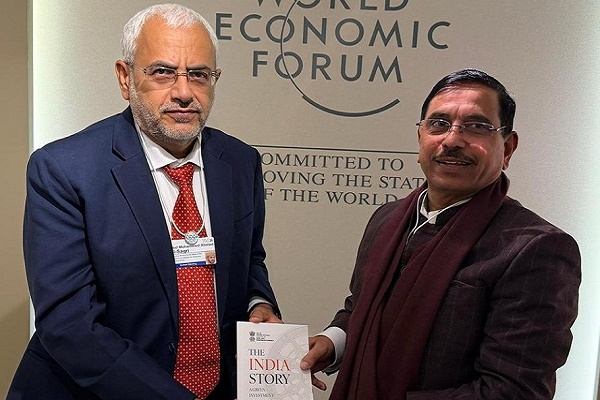

Consecutively for the third quarter, UPL reported dismal performance with YoY Revenue/ EBITDA decline of 18.7%/ 45.8% while reporting loss of Rs1.9bn. Performance remained muted across the verticals with relatively lower impact from Advanta. In Q2FY24, Differentiated and sustainable solutions revenues grew by 9% YoY, led by 17% volume growth supported by new products. Management cited UPL’s increased market share globally amidst the challenging times suggested by YoY volume growth of 1% in Q2. Except Brazil all the other markets largely witnessed volume growth. On debt front, UPL is expected to pare off USD500mn net debt by end-FY24E through lower capex, WC release, operating cash flows, and utilisation of cash reserves. Its cost reduction initiative is expected to yield USD50mn saving in FY24E and USD100mn in FY25E. Management guided 2H to be substantially better than 1H led by volume growth despite pricing pressure. UPL’s FY24E guidance remains quite optimistic with flat revenue growth and EBITDA growth of -5% to 0%. Amidst the current global agrochemical environment, achieving the guidance is likely to be a tall task and hence we have considered YoY revenue/ EBITDA decline of 5%/ 14% for FY24E. Purely based on valuations, we maintain Buy with a TP of Rs771 (earlier Rs949).

Except ROW, decline across markets

During Q2, UPL’s topline declined 19% YoY impacted by 7% decline in volumes, sizable 15% decline in pricing, while forex benefit of 3%. Destocking continues along with pricing pressure across the markets. Nonetheless, UPL’s global platform, UPL Corporation delivered 1% YoY volume growth amidst these challenging time although pricing declined by 25% YoY

Advanta delivers good performance

Advanta reported good performance with top-line growth of 10% YoY supported by 1% volume growth, 5% pricing, and 4% forex benefit. UPL SAS (India business) reported dismal performance with revenue decline of 36% YoY owing to 27% volume degrowth and 9% decline in pricing. UPL Specialty Chemicals too reported subdued performance with revenue/ EBITDA decline by 24%/ 6% YoY.

Optimistic guidance, seems difficult to achieve

Management guided for substantial volume growth in 2H supporting flattish YoY FY24E revenues growth however margin pressure to keep EBITDA lower than revenue growth. USD500mn net debt reduction target is continued for FY24E. We believe under the current global agrochemical environment, the guidance seems quite difficult to achieve. Based on 1H performance, we have lowered our FY24E/ FY25E EBITDA estimates by 15%/ 16% while introducing FY26E estimates. We have also lowered our EV/ EBITDA multiple for UPL SAS from 15x to 12x and UPL Corporation from 6.0x to 5.5x considering the current market conditions. We maintain Buy rating on UPL with SOTP-based revised TP of Rs771 (earlier Rs949). Demerger of UPL’s four platforms remains a medium term trigger for the stock. Risk – Lower than expected volume growth in FY24E, continued pricing pressure

For More Centrum Broking Disclaimer https://www.centrumbroking.com/disclaimer/

SEBI Registration No.:- INZ000205331