Buy Lupin Ltd for the Target Rs. 2,400 By Prabhudas Liladhar Capital Ltd

Strong beat aided by higher US sales

Quick Pointers:

* Margins revised upwards for FY26E by 100bps.

* Mgmt guides $275-300mn quarterly run rate in H2 FY26.

Lupin’s (LPC) Q2FY26 EBITDA stood at Rs21.4bn 20% beat to our estimates on the back of higher US sales supported by niche launches like gTolvaptan. LPC saw remarkable turnaround in profitability with ~2x jump in EBITDA over FY23- 24 aided by better product mix, continued niche launches in the US, clearance from USFDA for facilities, domestic formulations regaining momentum and cost optimization measures. We expect margins to sustain given a strong pipeline in the US. Our FY27E and FY28E EPS broadly remain unchanged. We maintain BUY rating with TP of Rs2,400 (24x Sept 2027E EPS). Any competition in gSpiriva and delay in new launches in the US will be key risks to our estimates.

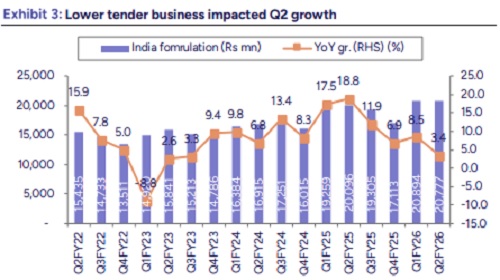

* Higher revenues aided by US & RoW markets: Revenues grew 24% YoY to Rs 70bn, vs our estimate Rs 66bn. Beat was on account of higher US, EMs and other operating income. US revenues came at $317mn, up 15% QoQ we estimated $300mn. Performance was largely aided by contribution from gTolvaptan and other new launches. India formulation grew by 3% YoY; below our est. EMs grew by 45%, while other developed markets increased by 19% YoY. API business was down by 13% YoY.

* GMs remain strong, EBITDA above est: The company reported EBIDTA of Rs21.4bn; up 63.4% YoY. 20% beat our estimates. OPM increased by +400bps QoQ at 30.3%. Increased contribution from gTolvapton supported margins. GM’s continue to remain strong at 73.3%, up 200bps QoQ given better product mix in US markets. R&D expenses increased by 14% YoY; 7.5% of sales at Rs 5.1bn. Ex R&D other expenses were up 21% YoY. The company booked forex gain of Rs2bn. Other operating income came in higher at Rs 2.1bn. Tax rate higher at 26%. Resultant PAT at Rs14.8bn, above our est. EPS of Rs 29.

Key Conference Call Takeaways:

* India business: Volume growth at 5.2%. Chronic portfolio at 65%. Key therapies such as GI, Cardiac and Respiratory outperformed. Targets 80 product launches by FY30. Revived respiratory and diabetes segments to drive near-term growth. Subdued growth in Q2 given lower tender business

* Semaglutide & peptide portfolio: Semaglutide expected in first wave in India (CY26); capacities secured through partners. Semaglutide & Tirzepatide under development (India and select EMs first).

* US: Net sales at $315mn, up 11.5% QoQ. Driven by gTolvaptan (180-day exclusivity), Mirabegron, and gSpiriva. Base products like gAlbuterol saw low single-digit price decline. gTolvaptan exclusivity to end soon; expecting limited new entrants $275–300mn/quarter guided for H2FY26. Expect to sustain +$1bn sales for FY27. gSpiriva: share stable; no near-term competition expected. Mgmt. remains confident of achieving favourable outcome in gMirabegron in Feb 2026. On respiratory pipeline, gDulera has been filed and couple of other large products are under development.

* Biosimilars: 5 products to be commercialized by FY30. Focus on ophthalmology and oncology (bPegfilgrastim) segments. Expect positive contribution from FY27E onwards.

* EMs: Growth driven by Brazil and SA markets. Brazil: turnaround driven by diabetes launches (Dapagliflozin, Empagliflozin). South Africa: portfolio restructuring complete; strong double-digit growth expected to sustain. EMs expected to maintain double-digit constant-currency growth.

* R&D and pipeline: Spent Rs 5bn (7.5% of sales) in Q2FY26. 70% directed to complex generics, injectables, and biosimilars. 50+ filings planned for the US; focus on respiratory, complex injectables, 505(b)(2)s, and green-propellantbased products.

* Other highlights: GMs 73.3% aided by better mix and lower in-licensed product share. FY26E EBITDA margin revised upward to 25–26%; sustainable margins for FY27E at 24-25%. ETR: 21–22% in FY26E.

Please refer disclaimer at https://www.plindia.com/disclaimer/

SEBI Registration No. INH000000271

.jpg)