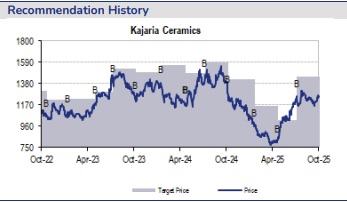

Buy Kajaria Ceramics Ltd For Target Rs. 1,525 By JM Financial Services

In-line quarter; cost discipline remains key focus

Kajaria Ceramics’ (Kajaria) EBITDA rose ~31% YoY and 14% QoQ to ~INR 2.1bn with EBITDA margin increasing by 393bps YoY/105bps QoQ to 18% (JMFe: 17.5%) in 2Q. The improvement in margin was mainly driven by cost-optimisation initiatives. Tiles volume marginally increased by ~1% YoY, while realisation was broadly flat QoQ. Adhesives segment reported revenue growth of ~77% YoY (~29% QoQ) to INR 322mn, while sanitary ware/faucets grew ~14% YoY/12% QoQ to ~INR 1bn in 2Q. The management will continue to focus on prioritising cost rationalisation and aims to improve margins along the way. It also plans to expand its distribution network and gain market share with focus on increasing exposure in government projects. Factoring in 2Q performance and the company’s increasing emphasis on profitability and cost discipline, we increase our EPS estimates by ~3-8% for FY26E-27E but maintain them for FY28E; accordingly, we maintain BUY with a revised TP of INR 1,525/sh based on 36x Dec’27 P/E post quarterly rollover.

* Result summary:

Kajaria registered tiles volume growth of ~1% YoY/~6% QoQ to 28.9msm; realisation dipped ~1% YoY/ was broadly flat QoQ at INR 364/msm. Revenue from the tiles segment was flat YoY/ grew 7% QoQ at INR 10.5bn in 2Q as the company saw soft demand in both domestic and export markets. Bathware division revenue grew ~14% YoY/~12% QoQ at ~INR 1bn while adhesives segment revenue increased by ~77% YoY/ 29% QoQ to INR 322mn in 2Q. EBITDA increased ~31% YoY/~14% QoQ to INR 2.1bn with EBITDA margin at 18% (JMFe: 17.5%) mainly led by cost-reduction measures. Working capital days declined by 3days YoY/2days QoQ to 56 days in 2Q. Net cash further increased by INR 780mn QoQ to INR 5.9bn as of Sep’25.

* What we liked: Cost optimisation and improvement in profitability; increase in net cash

* What we did not like: Weak demand

* Earnings call KTAs: 1) The company is focusing on reducing cost of packing materials, revisiting cost of raw materials, and renegotiating outsourcing materials, among other measures; it expects annual savings of INR 300mn-350mn. 2) It aims to achieve higher volume growth compared to the industry; exports grew by ~9-10% over the last 6 months. 3) The management has hired a fresh team of 18-20 members primarily to focus on reaching out to architects and influencers and expanding its distribution network. It has also hired a consultant to focus on market penetration and increasing its market share. Going forward, it plans to tap into government projects. 4) Its primary focus will be on increasing capacity utilisation; it has no immediate plans for capacity expansion. 5) On the cost front, power and fuel cost has been lower in 2Q on account of lower production, while cost per unit remains unchanged. However, the company incurred some savings on raw materials cost, which will get reflected in 3Q. 6) The management highlighted that advertisement expenses are likely to be higher in 2HFY26 compared to 1HFY26. 7) The company expects no significant PAT contribution from its Nepal plant in FY26. 7) Net cash increased by ~INR 2.6bn YoY/INR 780mn QoQ to INR 5.9bn as of Sep’25. 8) Working capital days declined by 3days YoY/2days QoQ to 56 days in 2Q.

Please refer disclaimer at https://www.jmfl.com/disclaimer

SEBI Registration Number is INM000010361

.jpg)