Buy Just Dial Ltd For Target Rs. 1,100 By JM Financial Services

Weak operating performance; cash distribution uncertainty continues

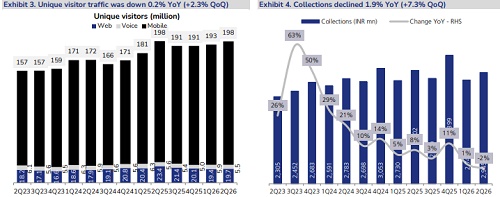

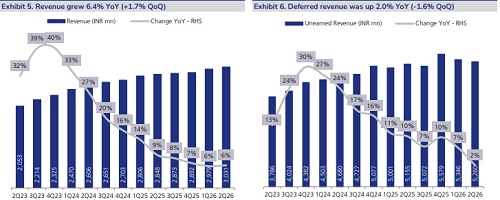

Just Dial's collections (lead indicator for revenue) in 2Q were down 1.9% YoY vs. +0.6% YoY growth reported in 1QFY26. The collections were weak despite decent increase in net paid campaigns by 6.6k QoQ versus 4k in 1Q and JMFe of 4.8k, likely due to a sharp pick-up in monthly plans over longer duration plans during this period. While revenue grew 6.4% YoY, inline with JMFe, EBITDA increase of 6.1% YoY to INR 871mn was behind our estimate by 2.4% on account of higher A&P spends. Traffic (quarterly unique visitors) was also sluggish, down 0.2% YoY despite the ramp-up in A&P spend. There was once again no clarity on the company’s muchawaited cash distribution policy, which could continue to weigh on the stock price performance in the near term despite valuations comfort. Just Dial’s shares currently trade at 6x FY26 PER after adjusting cash and investments - that account for ~76% of its market cap. We cut our target PER multiple (ex-cash and other income) to 14x (from 15x earlier) due to muted operating profit growth in core business and arrive at a revised Sept’26 TP of INR 1,100.

* Collections challenges sustain in 2Q: Just Dial’s revenue growth of 6.4% YoY (+1.7% QoQ) in 2Q to INR 3.03bn was weak considering that the management in the recent past had been suggesting that mid-teens growth was doable. In fact, collections were down 1.9% YoY vs. +0.6% YoY growth in 1QFY26. The collections were weak despite decent increase in net paid campaigns by 6.6k QoQ versus 4k in 1Q and JMFe of 4.8k, likely due to a sharp pick-up in monthly plans over longer duration plans during this period. Moreover, traffic trends remained flattish in 2Q despite an increase in A&P spend to INR 92mn from INR 85mn/INR 62mn in 1QFY26/2QFY25, respectively. Given the collections growth weakness in recent quarters, we conservatively build mid-single digit collections/top line growth in the near to medium term.

* Weaker-than expected operating profit due to A&P increase: Just Dial’s EBITDA margin declined 8bps YoY (-29bps QoQ) to 28.7%, a miss on JMFe of 29.3%. While employee cost (as % of revenue) was down 65bps YoY due to rationalisation of workforce in earlier qtrs, these gains were offset by ~74bps YoY increase in other expenses (mainly due to A&P increase by ~86bps). As a result, EBITDA growth was muted at 6.1% YoY to INR 871mn (+0.7% QoQ), a miss on JMFe by 2.4%. Going ahead, while we expect the company to increase A&P spends and other expenses from current levels (in % revenue terms) in order to revive traffic growth momentum, we do not foresee any meaningful increase in employee costs. Overall, we expect EBITDA margin to stabilise between 29-30%.

* Tweak earnings forecast basis 2Q results, TP revised down to INR 1,100: We lower our topline estimates for Just Dial by 0.5%-1.5% over FY26-28 to factor in the continued collections growth challeneges, while also lowering our margin forecast by 44-84bps. As a result, our FY26-28 EPS is cut by 1.6-3.3%. Due to weaker than expected operating performance, we now value the stock basis 14x core business EPS + Cash to derive a revised TP of INR 1,100 (vs. INR 1,150 earlier). While our rating for Just Dial remains unchanged due to extremely cheap valuations, in our opinion, meaningful returns are possible only if any clarity emerges cash distribution policy. This is because if the company were to announce cash distribution of at least 100% of its FY25 PAT (as indicated in the 1Q/4QFY25 earnings call) in the form of a dividend at CMP, the payout yield at CMP would be a lucrative ~8%.

Please refer disclaimer at https://www.jmfl.com/disclaimer

SEBI Registration Number is INM000010361