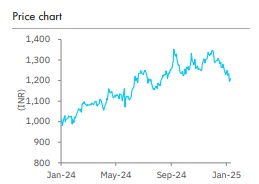

Buy ICICI Bank Ltd For Target Rs. 1,483 By Elara Capital Ltd

Exemplary resilience, setting benchmark high

ICICI Bank (ICICIBC IN) delivered yet another strong print amidst uncertainty, demonstrating excellent earning resilience, much better than peers. Q3 PAT of INR 118bn was marginally ahead of estimates on lower credit cost. Core profitability growth (ex-treasury) came in below trend, up 13% YoY, but curtailed credit cost aided >14% YoY earnings growth. The key highlight was curtailed slippages, well balanced growth and stability across key metrics. Investors may have a transitionary concern on belowtrend core PPoP growth, but this is not unique to the bank, but an industry phenomenon and would eventually align with strong compounding story. Also, commendable performance in such times does validate our confidence on different outcomes for the bank versus last cycle. With strong underlying and levers to continue delivering better risk-adjusted return, even on a high base, we see the risk of an earnings disappointment rather low. We believe ICICIBC has all it takes to be an industry benchmark this cycle and thus sustaining/bettering valuation premium. Maintain BUY with TP of INR 1,483 – ICICIBC is one of the top sectoral picks.

NIMs as expected; stability across key line items:

ICICIBC posted loan growth of 2.9% QoQ and 13.9% YoY, higher than peers, led by >6% QoQ growth in business banking and > 4% QoQ growth in corporate. The retail growth trend seems to have softened growing by 1.4% QoQ/10.5% YoY, given system challenges. One can argue on softer QoQ deposit growth of 1.5%, but ICICIBC highlighted this to be a more internal need than anything else. NIM declined by 2bps QoQ to ~4.25%, as expected. While NIM may be strained, we expect this to be more range-bound. Transition from high-teen core PPoP growth to lower-teen growth may render narrative dislocation, but it will eventually get adjusted as we believe ICICIBC has the levers to sustain overall earnings delivery with an ROA of 2% and an ROE of 15%.

Asset quality performance much better than peers:

Slippages were at INR 60.85bn (INR 50.7bn QoQ), with rise driven largely by agri (seasonal), a commendable performance in such an environment. Retail slippages were controlled, with ICICIBC confident of near-term trends. Credit cost was lower as ICICIBC had upgrades/repayments from certain BB & below rated portfolio. Coverage of >78%, NNPL of sub-50bp, contingent buffer at ~1.0% of loans, imply ICICIBC has buffers to ensure earnings consistency, missing for peers. We believe such performance will build investor confidence of changed underwriting, earmarking it as sector leader this cycle.

Recommend BUY with a TP of INR 1,483:

While factors may be strenuous for banking, ICICIBC may hold the tide with steady earnings and FY27E ROA of >2% and ROE of 15%. With transition for HDFC Bank, embargo on Kotak Mahindra Bank, ICICIBC is a clean play on best-in-class ROA. It should trade at a premium on high quality earnings. We retain Buy with SOTP-TP of INR 1,483. Maintain BUY. ICICIBC is our top pick in the sector.

Please refer disclaimer at Report

SEBI Registration number is INH000000933