Buy Gold on Dips with a target of Rs.1,06,000 in the Long Term – Motilal Oswal Financial Services Ltd

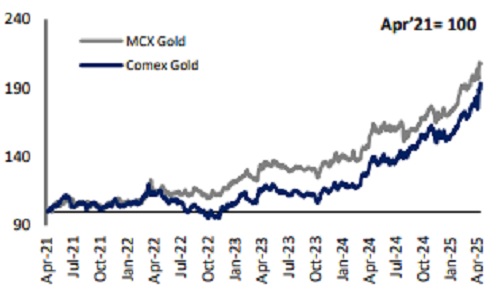

According to Motilal Oswal Financial Services Limited (MOFSL), it continues to maintain a buy on dips on Gold, wherein investors can start accumulating near mentioned support zone for the long term targets of Rs.1,06,000. Technically, from medium to long term perspective MOFSL sees support near Rs.90,000-91,000 while, resistance near Rs.99,000. The first quarter of 2025, for Gold and Silver was as astounding as the last year. In Q1’25, Gold posted gains of ~18%. In the new financial year as well, the rally continued, as gold marked an all time high of $3500 and very close to Rs.100,000. However, the tide turned quickly, as a sharp sell-off was witnessed moving forward, from record highs.

Mr. Manav Modi, Senior Analyst, Commodity Research at Motilal Oswal Financial Services Ltd said, “Demand and supply factors historically have not directly made an impact on gold prices, and especially in a scenario where there are more overpowering uncertainties present in the market. Gold prices have posted a sharp rally over the last couple of months, hence some cool off in prices cannot not be ruled out. There are both positives and negatives for Gold prices at this juncture, mixed economic data points, tariff war, higher inflation expectations, rise in slower growth concerns, rate cut expectations, geo-political tensions, concerns regarding rising debt, increase in demand and fall in US Yields could act as tailwinds for prices. Any updates regarding ease off in above mentioned uncertainties could put further pressure on bullion.”

Major factors triggering volatility in bullion market:

1) President Tariff threats: Tariff war with China and major nations – both US and China has levied more than 100% tariff on each other

2) Geo-political tensions – War like scenario in Middle east, China- Taiwan and elsewhere developing over the years

3) Fed monetary policy: Market expectations and Fed’s intent for an interest rate cut

President Trump’s Tariff Threat

In April 2025, gold prices experienced significant fluctuations driven by President Donald Trump’s economic policies. Earlier, Trump administration had targeted 50–60 trading partners to narrow the trade imbalance, sparking a full-blown trade war, especially with China. Tariffs rose as high as 145% on Chinese goods and 125% on U.S. exports, rattling global markets. Against this backdrop, gold surged to a record $3,500, as investors sought safety amid Trump’s tariff threats and public attacks on Fed Chair Jerome Powell, raising fears over the Fed’s independence. However, the rally was short-lived, as towards the end of last week in April, gold prices fell by more than 2% from an all-time high, as signs of easing U.S. China trade tensions emerged. As global markets react, gold remains a critical gauge of investor anxiety around trade and monetary policy risks.

The White House hinted at progress in tariff negotiations, and China responded by exempting certain U.S. imports from tariffs, despite downplaying claims of active negotiations. These developments reduced the demand for safe-haven assets like gold, leading to a decline in prices. However, President Trump's economic policies, including the imposition of a 10% tariff on all U.S. imports and calls for the Federal Reserve to cut interest rates despite easing inflation, have contributed to market volatility.

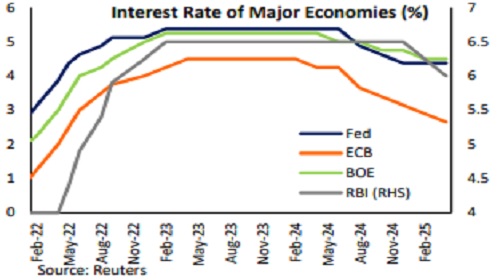

Fed policy decisions

Federal Reserve has maintained a cautious and datadependent stance, keeping the federal funds rate steady at 4.25%–4.5% after a series of cuts in late 2024. Slowing economic growth, now projected at 1.7% for 2025, and persistent inflation pressures above the 2% target are key factors behind the Fed's decision to pause further rate changes. Additionally, Fed has announced a significant slowdown in its balance sheet reduction program, lowering the monthly cap on Treasury redemptions from $25 billion to $5 billion to ensure sufficient liquidity. External risks, including renewed trade tensions under the Trump administration, have added to economic uncertainty, reinforcing the Fed’s patient and flexible approach. Despite political noise, particularly past criticisms from the White House, the Fed’s independence appears intact, with no current threat to Fed Chair’s leadership. Going forward, markets are pricing in the possibility of rate cuts later this year, but the Fed has made clear that any adjustments will be contingent on incoming economic data, especially inflation and employment dynamics.

Supply – Demand story

Central Bank continued to be a net buyer of Gold even in 2025, however, the buying has slowed amidst elevated gold prices. Amidst many positives, there are some factors that are adding a cap to the gains. Demand destruction in physical demand is a concern with gold prices surging to record highs and domestic physical market trading at a discount over the last few months. The chart here shows the time series of the difference between international US$ gold price and local gold prices paid by Indian and Chinese consumers in their respective markets. Discount in Indian gold went till $60 and then briefly recovered from there towards $27, where it is currently hovering. Higher discounts indicate weakened demand, hence, sustained lower demand in the physical market could weigh on overall sentiment.

Above views are of the author and not of the website kindly read disclaimer