Buy CreditAccess Grameen Ltd For Target Rs.1,960 By Emkay Global Financial Services

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

Post the strong Q2 results, CREDAG’s stock should be largely retraced to 3Mago levels post this week’s 11%+ move. We believe the stock will see continued momentum, given 2H being seasonally strong for the MFI sector, and hence also for CREDAG. Additionally, the company has guided for the continued strong margin/RoA delivery, while building healthy contingent buffers to withstand any future asset-quality shocks. We believe south-dominant MFI players including CREDAG will be better-off than northern/central peers, who face rising risk of political interference, while its strategy to gradually de-risk its balance sheet via portfolio diversification should augur well in the long term. Overhang of promoter’s/large shareholders’ stake sale too is now over for CREDAG which we believe remains a persistent threat for most NBFC-MFI players. Based on this, we believe CREDAG’s stock performance should largely track its superior financial performance and RoA/RoE delivery (at >5%/20%, respectively). We retain BUY on the stock, with target price of Rs1,960/share, valuing it at 3.3x Sep-25E ABV

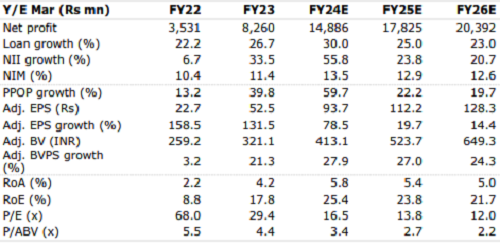

CreditAccess Grameen: Financial Snapshot (Consolidated)

For More Emkay Global Financial Services Ltd Disclaimer http://www.emkayglobal.com/Uploads/disclaimer.pdf &

SEBI Registration number is INH000000354

320-x-100_uti_gold.jpg" alt="Advertisement">

320-x-100_uti_gold.jpg" alt="Advertisement">