Building on strength: India`s Real Estate to scale up office and industrial assets beyond 2 billion sq ft by 2047 – CREDAI - Colliers

India’s real estate sector is set for a high-paced, multi-faceted growth across asset classes which is being driven by demographic shifts, infrastructure development, innovation and increasing focus on technology as well as sustainability.

The latest report— “Indian real estate: Fostering equity and fueling economic growth” by Colliers in collaboration with the Confederation of Real Estate Developers’ Association of India (CREDAI) and released at the CREDAI NATCON event in Singapore revolves around the five structural forces—urban expansion, infrastructure development, demographic shifts, digital transformation, and sustainability imperatives. These forces are converging to unlock new dimensions of opportunity, innovation, and resilience across real estate asset classes in the country. From established Tier I cities to emerging Tier II & III cities, the real estate narrative is becoming more balanced, equitable and inclusive. The report also charts the growth across real estate asset classes from the 1990s till date and forecasts the trajectory till 2047, the centennial year of India’s independence.

Mr. Shekhar Patel, President, CREDAI said “By 2047, Indian real estate will not just be measured in square feet or asset values—it will be defined by the quality of life we create for millions of citizens. The sector is uniquely positioned to reimagine India’s urban future: designing climate-resilient cities, building affordable yet aspirational homes, and nurturing ecosystems that foster innovation and inclusivity. As CREDAI, we see real estate as the foundation of India’s journey toward becoming a developed economy—where every new home, office, or warehouse contributes to social equity and sustainable growth. Our vision is to transform this sector into a model for the world, proving that rapid urbanization and environmental responsibility can go hand in hand. The coming decades are an opportunity to not just build structures, but to build the India of tomorrow.”

“India’s real estate sector is at the forefront of the country’s inclusive progress and is expected to scale into a USD 5-10 trillion market by 2047. Fueled by supportive policies, envisaged demand traction and rising developer as well as investor interest, Indian real estate is poised for decades of growth acceleration across most asset classes. Interestingly, both the Grade A office and industrial stock of the country is expected to surpass 2 billion sq ft mark by 2047. Residential sales could meanwhile double-up to 1 million units annually. Additionally, the ongoing spur in data centers, senior living facilities, retail malls and hotels are reflective of demand being driven by demographically diverse needs. Overall, the Indian real estate sector is set to remain a vital catalyst for inclusive urbanization and sustainable community development as the nation advances toward global economic leadership,” says Badal Yagnik, Chief Executive Officer, Colliers India.

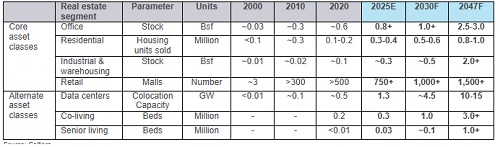

While Indian real estate has already transformed from a largely fragmented sector to a more organized and strategic contributor of nation development, the upcoming decades are likely to be characterized by quantum growth fueled by rising institutionalization amidst strong investor appetite and scaling up of demand. Overall, real estate will become a more prominent force in India’s economic growth story, with core segments like office, residential, industrial & warehousing and retail reaching varying degrees of growth and scale by 2047. The envisaged scaling up of multiple asset classes is indicated as below:

Trends in real estate asset classes of India -

Office and industrial & warehousing stock to cross 2 billion sq ft by 2047

Grade A office stock in India has surged over 3 times since 2010 to more than 800 million sq ft currently, driven by accelerated demand from both Global Capability Centers (GCCs) and domestic players across segments such as technology, BFSI, engineering & manufacturing etc. Traction in flex spaces too has added to the vibrancy of India’s office market.

On the industrial & warehousing front, Grade A stock levels surpassed 250 million sq ft mark in 2025, growing multifold compared to 2010 levels, amidst robust infrastructure development, private sector participation and evolving consumer demand as well as warehousing requirements.

Driven by increasing institutionalization, demand scale-up and strong economic growth prospects, overall stock in both these segments is likely to exceed 2 billion sq ft by 2047.

Demographic shifts & rising income levels to improve affordability & housing sales

In the 2010s, urban migration driven by IT led to a surge in demand for housing across Tier I cities of the country. Furthermore, the Real Estate (Regulation & Development) Act (RERA) brought in the much-needed transparency & accountability. Although housing sales took a hit in the immediate aftermath of the COVID-19 pandemic, the segment bounced back subsequently on a stronger footing — evident by record breaking sale volumes in recent years.

Over the next few decades, India’s median age is expected to rise further to 30-40 years, a range that aligns with peak income and consumption levels. This transition represents a sweet spot for the economy, as a significant proportion of the workforce enter their prime earning years. Coupled with anticipated rise in income levels and supported by progressive housing policies, annual housing sales could potentially double to 1 million units by 2047.

Retail, hospitality and alternate segments can potentially grow multifold levels

Other real estate segments like retail, hospitality and alternatives like data centers, senior living, and co-living too have picked up pace backed by demographic shifts, increase in disposable income and rapid digitalization. For instance, data center capacity in India has grown over 2.5X times to around 1,300 MW as on date. Penetration rates in co-living and senior living sub-segments too have increased significantly in the last few years.

Over the next few years, developers are likely to increasingly focus on real estate segments beyond office, residential and industrial & warehousing. Retail and hospitality segments particularly are expected to witness accelerated growth in the smaller cities, having high untapped potential. Moreover, the quantum growth in data centers and shared living facilities such as co-living and senior living will be driven by the changing needs of a digitally empowered and demographically diverse population.

Most importantly, the ascendancy of Indian economy and growth of real estate is likely to continue further driven by policy support and pivotal growth ingredients such as infrastructure development, rapid urbanization, adoption of climate resilient features in built structures etc.

Rapid urbanization, infrastructure growth and sustainability mandates to shape the real estate journey till 2047

Indian cities are urbanizing rapidly, with nearly 900 million people—53% of the population projected to live in urban areas by 2050, up from the current levels of 37%. To accommodate this growth, urban development needs to expand beyond the established Tier I cities into smaller Tier II & III cities and emerging growth corridors as well.

“India is not just expanding its infrastructure; it is reimagining the future of urban living. In the last 25 years, even though budgetary infrastructure allocations increased at a CAGR of 13-14%, a lot more needs to be done, especially in the wake of rapid urbanization. With more than half of the urban infrastructure for 2050 yet to be built, focal growth centers can potentially shift to emerging Tier II & III cities and newer economic corridors. To support this infrastructure developments, India would require more than USD 2 trillion investments by 2050. As new townships, retail hubs, and hospitality destinations take shape, India’s built environment is set to continuously evolve, laying the foundation for the next wave of economic growth,” says Vimal Nadar, National Director & Head of Research, Colliers India.

Moreover, with ambitious targets of 500 GW renewable energy capacity by 2030 and net-zero emissions by 2070, the real estate sector is increasingly aligning with green mandates. Developers are integrating solar energy, eco-friendly materials, and energy-efficient designs to create sustainable buildings that reduce operational costs and appeal to environmentally conscious buyers and investors. Interestingly, by incorporating renewable energy resources, Indian cities have the potential to reduce 50-80% of the CO2 emissions by 2050.

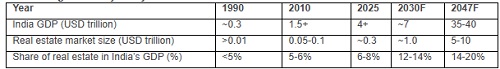

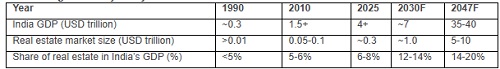

Indian real estate can potentially reach USD 10 trillion by 2047

As India gradually approaches its centennial year of Independence in 2047, the country currently stands at the cusp of a transformative economic journey. Driven by robust domestic demand, rapid urbanization, infrastructure-led expansion, real estate & construction sector growth and digital acceleration, India has already emerged as the fourth largest economy globally. Moreover, continued government impetus along with alignment of multiple private and public stakeholders should help India become the third largest economy by 2030. Further, the Indian economy can potentially reach USD 35-40 trillion by 2047, provided the growth pace is not halted by global black swan events.

At the core of this economic transformation is India’s real estate sector, which has evolved from a localized industry during the 1990s into a pragmatic and relatively institutionalized sector. Its contribution to the GDP has grown steadily—from under 5% in the early 2000s to 6–8% today and is projected to reach 14–20%, positioning it as a potential USD 10 trillion growth catalyst by 2047.

Trends in growth trajectory of India and real estate sector

Share of REITs in real estate market capitalization can increase to 40-50% by 2047

India’s Real Estate Investment Trusts (REIT) market is currently minuscule in comparison to global counterparts. However, the momentum of REITs in India is steadily gathering pace backed by rising investor confidence, strong regulatory environment, increasing asset diversification and growing focus on institutionalization of the real estate sector. The share of REITs in the real estate market capitalization is likely to increase from 10% currently, to 40-50% by 2047. Within the REIT market, office segment particularly is expected to remain dominant in 2047 as well. REIT penetration in office market is likely to surge from 16% in 2025, to more than 60% by 2047.

Above views are of the author and not of the website kindly read disclaimer