Bank Nifty support is at 48250 then 48000 zones while resistance at 49000 then 49250 zones - Motilal Oswal Wealth Management

Morning Market Outlook

* The market is expected to open slightly lower due to weak Asian market performance, concerns over possible reciprocal tariffs from the US, and ongoing selling by FIIs.

* Asian markets fell by up to 2% following US President Donald Trump's decision to restrict Chinese investments and proceed with scheduled tariffs on Canada and Mexico.

* The US markets closed mixed, with the Nasdaq Composite dropping 1.2% due to a decline in IT stocks, ahead of Nvidia’s results announcement on Wednesday.

* From October 2024 to February 2025, FIIs have offloaded more than Rs3 lakh crore, which is causing concern. The Nifty is approaching its longest losing streak in 28 years and is on track for a potential fifth consecutive monthly decline, a situation last seen in 1996.

* Focus on GRSE, Berger Paints. Tata Play, Airtel Digital TV in merger talks as DTH industry struggles amid streaming boom.

* The GIFT Nifty is flat to negative

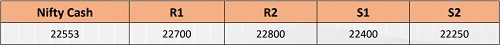

NIFTY (CMP : 22553) :

Nifty immediate support is at 22400 then 22250 zones while resistance at 22700 then 22800 zones. Now till it holds below 22800 zones, weakness could be seen towards 22400 then 22250 zones whereas hurdles are placed at 22700 then 22800 zones.

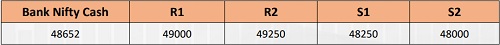

BANK NIFTY (CMP : 48652) :

Bank Nifty support is at 48250 then 48000 zones while resistance at 49000 then 49250 zones. Now till it holds below 48750 zones some weakness could be seen towards 48250 then 48000 zones while on the upside hurdle is seen at 49000 then 49250 levels.

Derivative Outlook

* Nifty February future closed at 22,612.65 with a premium of 59.30 point v/s 26.70 point premium in the last session.

* Nifty Put/Call Ratio (OI) decreased from 0.82 to 0.71 level.

* India VIX decreased by 0.60% to 14.44 level.

* On option front, Maximum Call OI is at 23000 then 22700 strike while Maximum Put OI is at 22600 then 22000 strike. Call writing is seen at 22600 then 22700 strike while Put writing is seen at 22600 then 22500 strike. Option data suggests a broader trading range in between 22000 to 23000 zones while an immediate range between 22400 to 22800 levels.

* Option Buying : Buy Nifty 22600 Put if it holds below 22800 zones. Buy Bank Nifty 48500 Put till it holds below 48750 zones.

* Option Strategy : Nifty Bear Put Spread (Buy 22600 PE and Sell 22400 PE) at net premium cost of 50- 60 points. Bank Nifty Bear Put Spread (Buy 48600 PE and Sell 48200 PE) at net premium cost of 80- 100 points.

* Option Writing : Sell Nifty 22200 PE and 23000 CE with strict double SL. Sell Bank Nifty 47800 PE and 49500 CE with strict double SL.

Fundamental Outlook

Global Market Summary:

* US markets ended mixed, as investors assess the potential impact of on schedule tariff on Canada and Mexico.

* Dow was up by 0.1%, S&P down 0.5% and NASDAQ was down 1.2% • European markets ended on a mixed note.

* Dow Futures is up 135 points (+0.3%)

* Most Asian markets are mostly down 0.5-1%.

* Global Cues: Mixed

Indian Market Summary:

* Indian market fell sharply reaching an 8-month low, tracking U.S. equities which tumbled on Friday on concerns over weaker-than-expected economic data.

* Benchmark index Nifty ended 243 points lower at 22,553 level (-1.1%)

* Broader market too witnessed selling pressure with Nifty Midcap and Nifty Smallcap indices down 1% each.

* FIIs: -Rs6,287 crore DIIs: +Rs5,186 crore.

* Currently GIFT Nifty is indicating a flat opening.

* Domestic Cues: Muted

News and Impact :

* Havells India: Havells India Ltd. will enter the electric vehicle charging market in the next six months as the company eyes to tap into the lucrative sunrise sector set to buzz after the entry of Elon Musk's Tesla. The company will tap automakers, charging infrastructure, consumers and real estate developers. Impact: Positive

* Biocon: Biocon Biologics, a subsidiary of Biocon, introduced Yesintek Biosimilar in the U.S. for the treatment of Crohn’s disease, ulcerative colitis, plaque psoriasis, and psoriatic arthritis. Impact: Positive

Fundamental Actionable Idea

360 One WAM : CMP INR1009, TP INR1250, 24% Upside, Buy

* 360 ONE WAM’s management hosted an analyst call, wherein it highlighted that the B&K acquisition is a strategic fit, enhancing business through equity advisory for existing clients, benefiting corporate advisory, and leveraging 360ONE’s relationships to scale IB operations.

• The deal is expected to be EPS-accretive by 3-5%. B&K business is projected to grow at a 15-25% revenue CAGR over 3-5 years, driven by existing and new customers.

* In the core business, 360 One is poised to gain market share in current market corrections, with clients holding 10-20% cash for equity deployment.

* HNI business should scale in 12-18 months, while the global business is set to grow near term.

View: Buy

Union Bank of India : CMP INR117, TP INR135, 15% Upside, Buy

* Government approves Rs.2,000 cr QIP plan for each of 5 Public Sector Banks (PSBs) while DIPAM also gets Mandate to sell stake in the 5 PSBs via OFS

* As per media sources, Govt invites bids from merchant bankers for select PSU Banks stake sale. The bankers will be empanelled for 3 years

* We like Union Bank of India, which also hosted analyst meet yesterday and emphasized the bank's efforts in delivering profitable growth while continually making investments in business and enhancing its technological capabilities.

* Management has guided FY25E advances growth to be ~11% and NIMs to remain at 2.8-3.0%, despite the rate cut, supported by higher MCLR-linked loans

* Further, a lower credit cost and controlled restructuring provide a better outlook on asset quality.

Quant Intraday Sell Ideas

What is this?

Based on technical indicators this strategy gives 2 stocks that have a high likelihood to fall during the day (from open to close). This is an intraday Sell strategy which can provide a good cushioning during a black swan event.

What are the rules?

* Stock names will be given at market open (9:15 am)

* Recommended time to entry: between 9:15 to 9:30 am.

* Entry: We short 2 stocks daily (intraday)

* Exit: we will exit at 3:15 as this is an intraday call

* SL: is placed at 1% of the open.

* Book profit: At 1% fall since open.

* In special situations the book profit might be delayed if the stock is in free fall.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412