Bank Nifty support at 55670; below this, may fall to 55360-55180 levels - Nirmal Bang Ltd

Market Review:

Indian benchmark closed with modest gains on Friday, extending their winning run to a second session. The Nifty ended above the 24,890 level, supported by buying interest in metals, PSU banks and consumer durables. The S&P BSE Sensex, jumped 223.86 points or 0.28% to 81,207.17. The Nifty 50 index gained 57.95 points or 0.23% to 24,894.25.

Nifty Technical Outlook

Nifty is expected to open on a negative note and likely to witness range bound move during the day. On technical grounds, Nifty has an immediate support at 24790. If Nifty closes below that, further downside can be expected towards 24700-24640 mark. On the flip side 24950-25000 will act as strong resistance levels.

Action: Nifty has an immediate Support at 24790 and on a decisive close below expect a fall to 24700-24640 levels.

Bank Nifty

Bank Nifty’s next immediate support is around 55670 levels on the downside and on a decisive close below expect a fall to 55360-55180. There is an immediate resistance at 55970-56250 levels.

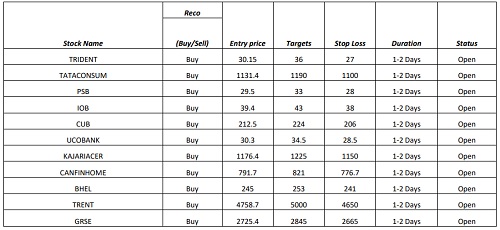

Technical Call Updates

Please refer disclaimer at https://www.nirmalbang.com/disclaimer.aspx

SEBI Registration number is INH00000176

.jpg)