Bank Nifty continued its winning streak for tenth-consecutive session and settled at 55,147 up 0.47% - ICICI Direct

Nifty :25239

Technical Outlook

Day that was…

Equity benchmark witnessed four-month highest close amid hopes of progress in India-US trade talks and anticipation of a US Fed rate cut buoyed sentiment and settled at 25239, up 0.68%. Market breadth was in favor of advances, with an A/D ratio of 2:1 where broader markets outperformed the benchmark. Midcap and Small cap closed on a positive note up 0.54% and 0.95% respectively. Sectorally, barring FMCG all indices closed in green. Where, Auto, Realty and IT outperformed.

Technical Outlook:

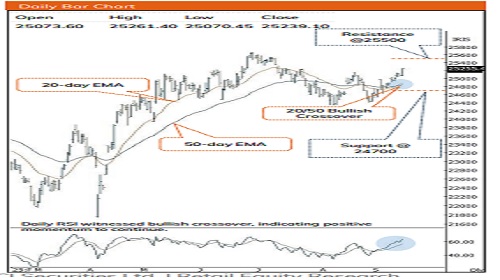

* Nifty started the day on a flat note, where buying demand emerged in the vicinity of previous sessions which propelled the index to its highest close since July. As a result, the daily price action formed a strong bull candle indicating, continuation of the upward momentum.

* Key point to highlight is that, Index witnessed resolute breakout from contracting triangle (25100-24400) fueled by across sector participation indicating conclusion of corrective bias and now opened the gate towards 25500 in coming weeks. Index witnessed bullish crossover of 20 days EMA above 50 days EMA while sustaining above its long-term moving averages, indicating inherent strength. Further, the US Dollar index has been sustaining below the immediate support of 97, that bodes well for emerging markets. Looking at the improvement in the broader structure, we revise our support to 24700 being 61.80% retracement of the upmove from (24404-25261).

* On the sectoral front, key index heavy weights like Bank Nifty and IT (carrying 45% weightage in Nifty) are getting ready for next leg of up move. Since December 2022, Bank Nifty is trading in a channelized move wherein the intermediate correction are getting arrested within 10% (average). While history suggest that, buying Bank Nifty near 52 weeks EMA has been fruitful over next 8 months. With current 7% correction, Bank Nifty approached 52 weeks EMA, suggesting index is approaching price wise maturity of correction amid oversold condition that augurs well for impending pullback. Meanwhile, Nifty IT index past 10 years data suggest that 35% correction offers incremental buying opportunity. With current 33% correction along with improvement in global macros (rate cut) would help index to revive upward momentum. Thereby offering favorable risk reward setup.

* On the market breadth front, the % of stocks above 50 days SMA have once again maintained the rhythm of bouncing from bullish support zone of 25%. The current jump to 60% clearly signifies broadening of market participation. On the broader market front, both Nifty Midcap and small cap have bounced from the vicinity of 52-week EMA amid oversold conditions, indicating an incremental buying opportunity from medium term perspective.

* Key monitorable:

* a) Development of Bilateral trade deal negotiations.

* b) FOMC Meet.

* c) Breakdown from one year falling trend line in US 10 Year Bond Yield

Nifty Bank : 55148

Technical Outlook

Week that was:

Bank Nifty continued its winning streak for tenth-consecutive session and settled at 55,147 up 0.47%. Nifty Private Bank index has relatively outperformed the benchmark, ending the day at 26927 up 0.78%..

Technical Outlook:

* Bank nifty opened the day on a positive note, after initial decline, index witnessed supportive buying demand in the vicinity of previous session low and closed higher. Consequently, the daily price action formed a strong bull candle carrying higher-high-low structure, indicating continuation of upward momentum.

* Key point to highlight is that index has formed higher-high-low structure for tenth-consecutive day and witnessed a decisive breakout from the falling trendline resistance. Index has maintained its position well above the 20-day EMA for the thirdconsecutive session, signaling strength in the ongoing uptrend. Going forward, any positive outcome from the US fed policy meeting along with tariff negotiation could act as a trigger, driving the index towards its previous swing high of 55,900. On the momentum front, weekly stochastic oscillator has maintained its bullish crossover, with reading of 43, reflecting continuation of current upward momentum. Hence, with the above improvement in index we revise our support to 54200 being 61.8% retracement of the current up move (53,561-55,185) and any decline from current level should be viewed as a buying opportunity.

* Structurally, Since Dec-22 the intermediate correction within channelized move has been arrested within 10%. While buying near 52 weeks EMA has been fruitful over next 8 months. With current 7% correction Bank Nifty approached 52 weeks EMA, suggesting index is approaching price wise correction. Hence, immediate strong support is placed near the 200-day EMA placed at 53600.

* PSU Bank Index has mirrored the benchmark and closed on a positive note. Index has sustained above the recent upside gaps and consolidating near its previous swing high near 7149, thereby a decisive close above this high would open the gate for next leg of up move. However, immediate support is placed near the rising trendline, aligning with the 50-day EMA (6935)

Please refer disclaimer at https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

SEBI Registration number INZ000183631