Bank Nifty breaks its two days of losing streak and closed on a positive note to settled at 55,509 up 0.41% - ICICI Direct

Nifty : 25202

Technical Outlook

Day that was…

* Equity benchmark declined for the Third consecutive session amid sharp decline in Rupee witnessing record low. Nifty settled the day at 25169, down 33 points. Market breadth was in favor of declines, with an A/D ratio of 1:1.30 where broader markets underperformed the benchmark. Midcap and Small cap closed on a negative note down 0.35% and 0.50% respectively. Sectorally, FMCG, Realty and IT were the laggards. Whereas, PSU Bank, Metal and Auto Outshone.

Technical Outlook:

* Index oscillated 450 points in Tuesday’s weekly expiry volatile session and closed on a flat note. As a result, the daily price action formed a high wave candle carrying lower-low, indicating breather.

* Nifty likely to open negative tracking comments from Fed chair Powell. Key point to highlight is that, index is undergoing healthy retracement where supportive efforts in the vicinity of 20-day EMA emerged and achieved the equality target of 360 points decline mirroring with 4th and 5th September 2025 fall, in the process it retested the contracting triangle breakout and witnessed a rebound indicating, inherent strength. Going ahead, a decisive close above previous sessions high would indicate pause in the down move and will challenge 25500 levels as broader structure remains intact and will eventually pave the way towards 25800 in coming month, wherein strong support is placed at 24700.

* Structurally, the rebound from April 2025 low till June 2025 high witnessed shallow retracement as it not even retraced 38.20% of the entire upmove while within the decline the pullback were limited to the tune to max 800 points the current upmove was >1000 points backed by across sector participation on the back of GST reforms which helped to improve market breadth while maintaining higher peak and trough intact, highlighting inherent strength. All eyes are on the progression of tariff negations. Any announcement on scrapping of additional 25% tariff or lowering reciprocal tariff rates would fuel further momentum in the market. Consequently, focus will shift towards export-oriented Textile, Capital Goods and Pharma stocks.

* Mirroring the Dow Jones move, Russell index (US Small cap index) clocked a fresh All Time High after 2021, indicating broadening of global rally.

* On the domestic broader market front, in a bull market scenario, average decline in Midcap and Small cap indices have been 27% and 29%, respectively. Buying in such scenario has been fruitful with >50% returns in subsequent 9-12 months. In the month of April, after 23% and 27% correction in Midcap and small cap, indices witnessed a sharp rebound and made a higher base in the vicinity of 52- week EMA. Currently, Midcap index is shying away 3% from its All Time High while small cap index is 8% away from All Time High. Hence, focus should be on accumulating quality stocks on dip.

* Our positive stance is further validated by following observations:

* a) Sentiment indicator at lows: Historically, rare occurrence of India Vix closing below 11 has eventually garnered double digit returns in subsequent 12 months.

* b) Market breadth: Constant improvement in market breadth highlights inherent strength. Currently, 55% stocks are trading above 50 days SMA while 66% stocks are trading above 200 days SMA compared to one month back reading of 41% and 58%, respectively

Nifty Bank : 55285

Technical Outlook

Day that was:

* Bank Nifty breaks its two days of losing streak and closed on a positive note to settled at 55,509 up 0.41%. Nifty PSU Bank index has outperformed the benchmark, ending the day at 7,451 up 1.09%.

Technical Outlook:

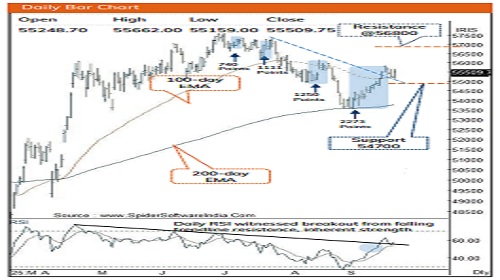

* Bank nifty started the day on a positive note, after initial decline index has witnessed supportive buying demand in the vicinity of previous session low. As a result, the daily price action formed a bull candle with lower shadow, signaling resumption of the prevailing up move .

* Key point to highlight is that Bank Nifty has retraced 38.2% of the preceding up move(53,561-55,853), coinciding with the 50-day EMA, indicating formation of a higher base above the key support zone. Going ahead, a decisive close above the previous twosession identical high which would help index to resolve above the recent swing high(55,835) and eventually head towards 56800 being 80% retracement of the preceding decline (57628- 53578). has formed identical highs at 55,666 from past twosession, a decisive close above this level would confirm a pause in the down move and signal a resumption of the uptrend. After favorable GST reforms now, all eyes are on the progression of tariff negations, any positive outcome could act as a trigger. Hence any decline from current level should be viewed as a buying opportunity, as immediate support is placed at 54500 being 50% retracement of the current up move (53,561-55,540).

* Structurally, Over the past 8-weeks of decline, the index has retraced 38.2% of its preceding 16-week, 21% rally, reflecting a slower pace of retracement. The subsequent rebound stands out as the strongest among the last three recovery attempts, reinforcing the view that the resumption of uptrend after slower pace of retracement.

* PSU Bank Index has relatively outperformed the benchmark and closed on a positive note. Index staged a strong rebound in the vicinity of previous breakout point (7305), which is now turning as support as per the rule of polarity, indicating renewed buying interest and potential for further upside momentum towards its measured move target at 7690. How

Please refer disclaimer at https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

SEBI Registration number INZ000183631