Bajaj Allianz Life`s sustainable & profitable growth trend picks pace in FY2024

.jpg)

Bajaj Allianz Life Insurance, one of India’s leading private life insurers, continues to demonstrate robust performance and strategic growth as per the annual business numbers of FY2024.

The Individual Rated New Business (IRNB) for FY2024 surged by an impressive 21%, showcasing the Company's resilience and adaptability to market changes, outpacing the private industry average growth rate by a significant margin of more than 2x. New Business Value crossed the mark of Rs.1,000 crore for the first time at Rs.1,061 crores in FY2024. The Retail Number of Policies (NOP) saw a remarkable uptick of 22%, with 7.46 lakhs policies issued in FY2024 compared to 6.13 lakhs during FY2023, indicating a growing customer base. The Company has recorded its highest ever Assets Under Management (AUM), standing at Rs.1,09,829 crores as of March 31st, 2024, underlining BALIC’s strong financial position and commitment to prudent asset management. Additionally, Renewal premiums for FY2024 surged to Rs.11,549 crores, marking an impressive 32% growth compared to Rs.8,724 crores in FY2023. The Company has also demonstrated its unwavering commitment to efficient and reliable claim settlement services through its impressive Retail Claims Settlement Ratio of 99.23%, signifying significant progress towards its ultimate promise.

Bajaj Allianz Life also announced bonuses for the 23rd consecutive year. This year it was for over 11.66 lakh policyholders who have trusted the Company’s participating products. It was the Company’s highest bonus ever at Rs.1,383 crores for FY2024.

Bajaj Allianz Life's strong focus on its omnichannel distribution has led to steady growth across all channels. The Company’s Institutional Business has forged strong partnerships across the country and has achieved a growth rate of 17% in terms of IRNB. The Agency channel being one of the largest in the industry, with over 1.5 lakh agents has recorded a business growth of 20% in FY2024. One of the Company's youngest channels, its Proprietary Channel, has shown remarkable growth during the year at 49% in terms of IRNB compared to FY2023.

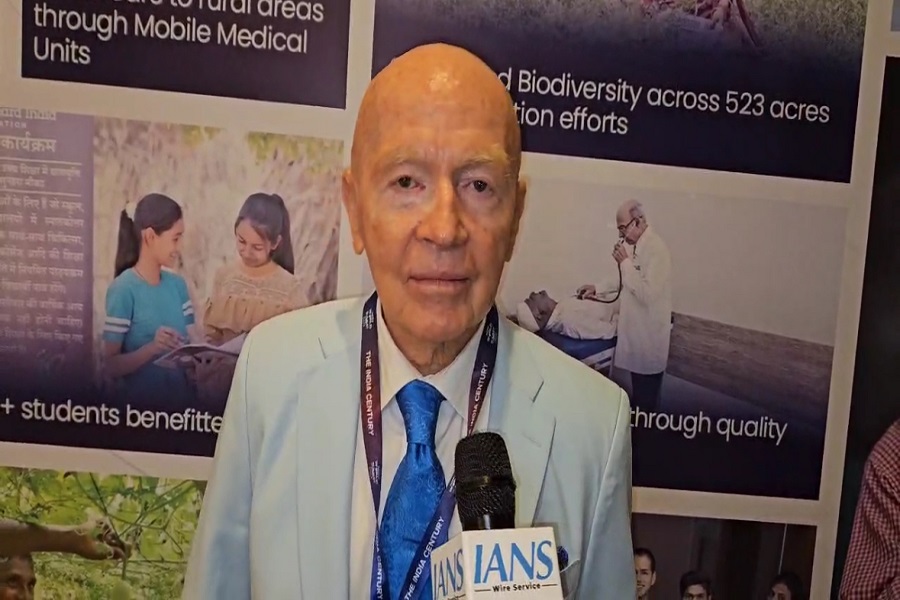

Commenting on the growth achieved by the Company, Bajaj Allianz Life’s MD and CEO, Tarun Chugh said, “Our persistent focus on customer-centricity, contextual innovation and operational excellence has driven Bajaj Allianz Life to reinforce its position as one of India's leading life insurance providers. We are happy to have recorded substantial growth across key business metrics and that reflects the trust that our customers have continued to place in us. This sustainable growth owes much to our nationwide network of partners and our motivated workforce. With a robust roadmap and wheels in motion, I am confident that we will sustain our upward trajectory."

Bajaj Allianz Life stands out with its diversified distribution reach, offering accessibility through 530+ branches nationwide. Innovative products like Bajaj Allianz Life ACE and Bajaj Allianz Life Magnum Fortune Plus cater to diverse customer needs, while digital assets like the Customer app and Whatsapp Customer BOT ensure widespread adoption and enhanced customer experience. Testament of the same is in the new participating product Bajaj Allianz Life ACE launched in July, 2023 which contributed significantly to new business in FY2024. Through continued efforts towards enhancing products and services, Bajaj Allianz Life is committed to the mission of assisting individuals in achieving their life goals with ease.

KEY NUMBERS AS OF 31st MARCH, 2024:

· Bajaj Allianz Life has achieved a remarkable growth rate of 12% for net New Business Value, standing at Rs.1,061 crores in FY2024 compared to Rs.950 crores in FY2023, crossing the mark of Rs.1,000 crores for the first time.

. The notable expansion speaks volumes about the Company's strong product lineup and serves as a genuine indication of its ability to generate profits and enhance shareholder value.

· The Company has achieved five-year IRNB CAGR of 29%

. 21% growth in IRNB in FY2024 clocking Rs.6,326 crores as compared to Rs.5,214 crores in FY2023

· The Company recorded its highest ever Gross Written Premium of Rs.23,043 crores, marking an 18% increase, primarily driven by robust growth in individual business and renewal premium.

· Profit After Tax (PAT) increased significantly to Rs.563 crores in FY2024 from Rs.390 crores in the corresponding period last year, reflecting an impressive growth of 44%.

· The Company's Solvency Ratio stands at a notable 432%, underlining its strong financial stability and ability to meet its obligations.

Above views are of the author and not of the website kindly read disclaimer