Add Cyient DLM Ltd For Target Rs. 530 By JM Financial Services

Order book growth provides some comfort; maintain ADD

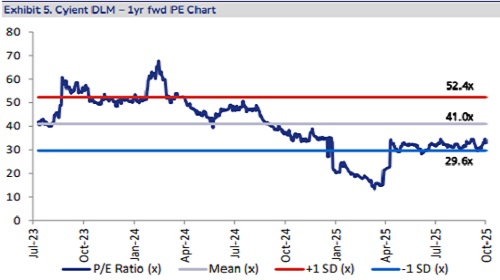

While Cyient DLM’s 2QFY26 performance was weak, momentum around the order book was a key positive. Cyient DLM’s 2Q adj. PAT declined 19% YoY, while revenue declined 20% YoY. However, an improved gross margin profile, given a superior customer mix drove a 190bps EBITDA margin expansion, driving a flat EBITDA on a YoY basis. On the order book, consolidated order inflows rose to INR 4.7bn in 2QFY26, vs. INR 2.4bn in 2QFY25, indicating a book-to-bill ratio of 1.5x. This, in turn drove a 16% YoY growth in the consolidated order book to INR 22.9bn, alleviating order book concerns to some extent. Incrementally, management guided for 1.4-1.5x book-to-bill ratio for FY26E. We also note that 20% of the new orders have come from Cyient DLM’s B2S business, which involves designing, and is an inherently higher margin business with sticky relationships. To adjust for the weakness in 1H, we cut our FY26E EPS estimates by 14%. At the same time, our FY27E EPS estimates remain largely unchanged, while FY28E EPS increases by 6%. We value the stock at 30x Sep’27E EPS, Maintain ADD.

* Cyient DLM 2Q YoY performance weak on expected lines, but beats estimate: 2Q revenue at INR 3.1bn was in-line with estimate, and declined 20% YoY. Here, revenue from the defence vertical declined 90% YoY to INR 249mn, constituting 8% of revenue vs. 66% of revenue in 2QFY25, owing to completion of a single large low-margin order in FY25. Besides this, revenue from the Aerospace vertical rose 48% YoY, constituting 37% of total revenue vs. 20% YoY. The Industrial and MedTech verticals also saw robust growth, and now constitute 30% and 16% of total revenue vs. 7% and 6% respectively in 2QFY25. This was driven by the acquisition of Altek, included in the current quarter but was absent in the base quarter. However, strong gross margins at 41.2% vs. 40.2% sequentially and 20.6% YoY drove a flat YoY EBITDA, which was 12% ahead of estimate. EBITDA margin at 10% was 100bps ahead of estimate and expanded 190bps YoY. Adj. 2Q PAT at INR 125mn, declined 19% YoY, but was better than our estimate.

* Order book improvement a key positive; management indicates trends should continue: Consolidated order inflows rose to INR 4.7bn in 2QFY26, vs. INR 2.4bn in 2QFY25, indicating a book-to-bill ratio of 1.5x. This drove a 16% growth in the consolidated order book to INR 22.9bn, after a flat YoY performance in the previous quarter and seven quarters of YoY decline prior to that, alleviating order book concerns to some extent. Incrementally, management guided for 1.4-1.5x book-to-bill ratio for FY26. We also note that 20% of the new orders have come from Cyient DLM’s B2S (designing, inherently higher margin and sticky relationship) vertical, and the overall order book has an execution period of 18-24 months.

* Focus on non-A&D businesses and foray into auto to be key drivers of growth: We believe that Cyient DLM’s ramp up in the non-A&D (aerospace and defence) segments will be key drivers of growth hereon. With the acquisition of Altek in FY25, Cyient DLM strengthened its hold over the Industrial and MedTech verticals. While the Company was present in these verticals before the acquisition as well, the ramp up was not too exciting. Further, the Company has gotten active in the automotive segment, especially the electric vehicle (EV) space as well. Herein, initially, it intends to focus on products required in setting up EV infrastructure. The Company also onboarded a new client in this segment in 2Q, wherein it will supply subassemblies that go into the EV charging systems. At the same time, Cyient DLM continues working on several other potential customers within the automotive segment, which are expected to become key accounts over the next several quarters.

Please refer disclaimer at https://www.jmfl.com/disclaimer

SEBI Registration Number is INM000010361