Accumulate KEC International Ltd for Target Rs. 1,020 by Elara Capitals

FY26 outlook positive led by T&D

KEC International (KECI IN) reported in-line top-line growth, slightly lower than revised guidance on execution challenges due to labor shortage and a slowdown in water projects due to delay in payments. However, for FY26, management has a revenue growth target of 15% YoY, led by order inflows of INR 300bn during the year along with a margin improvement to 8-.08.5%. We raise our TP to INR 1,020 on 17x March FY27E P/E, due to continued momentum in order inflows from domestic and international markets along with robust orderbook position. But we revise to Accumulate as the stock has outperformed the Nifty by 24% in the past three months vs the Index at 10%.

FY25 sales guidance of 15% growth: FY25 top line grew 10% YoY to INR 218bn, slightly missing revised guidance of 12-14% growth (earlier guidance of 15%), due to labor shortage and moderation in water orders execution on delay in receipt of payments. However, KECI has received payment of INR 1.4bn in Q1 to date and a significant amount in Q4YF25 also in relation to these projects. As a result, it has resumed execution of water projects at full strength hereafter. For FY26, management has a growth target of 15% YoY, led by the T&D segment and robust order inflows in FY26 along with better execution. It also targets to grow cables top line to INR I23-24bn in FY26 and INR 34-35bn in FY27, led by a capex of INR 800- 900mn in FY25 and INR 1.5bn in FY26.

FY26 margin guidance of 8.0-8.5%: Q4FY25 EBITDA margin rose 150bp YoY to 7.8% while FY25 improved 80bp YoY to 6.9%, led by reduction in the working capital cycle, operating leverage, and cost optimization. For FY26, management has set a margin target of 8.0-8.5%, led by better pricing orders, increased share of T&D, and targeting higher value EPC orders to reduce capital blocked in lower value projects. The company also targets to ramp up margin for the civil segment to 7-8% and cables margin to 8.0% from the current levels of 5.7% in the upcoming years.

Inflows grow 36% YoY in FY25: FY25 order inflows surged 36% YoY to INR 247bn, similar to guidance of INR 250bn inflows during the year. Out of this, T&D constituted 72% of inflows, from domestic and international markets. Overall, international orders formed 44% of order inflows, with robust demand witnessed from the Middle East, the African Union and SAARC countries. During the year, the company achieved several milestones including successfully completing the first Kavach order and securing additional orders, acquiring maiden orders for ropeway & gauge conversion, and winning first orders for STATCOM & semiconductor projects. For FY26, management has a INR 300bn target worth of order inflows.

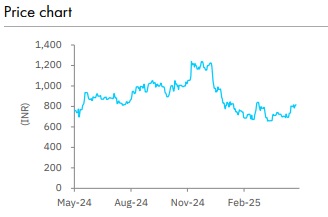

Revise to Accumulate with a higher TP of INR 1,020: We lower our FY26E earnings by 10% and FY27E earnings by 6% on delay in margin improvement as per earlier guidance. We introduce FY28E. We raise our TP to INR 1,020 from INR 950 on 17x (from 16x) March FY27E P/E due to continued momentum in order inflows from domestic and international markets along with a robust orderbook position. But we revise our rating to Accumulate from Buy as the stock has outperformed the Nifty by 24% in the past three months vs the Index at 10%. We expect an earnings CAGR of 48% during FY25-28E with an average ROE and ROCE of 22% & 18%, respectively, during FY26-28E.

Please refer disclaimer at Report

SEBI Registration number is INH000000933

.jpg)