What are the different types of IPO?

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel https://t.me/InvestmentGuruIndia

Download Telegram App before Joining the Channel

The initial public offers are they way by which the growth-driven Companies raise capital in the primary market for the first time to fuel their future growth. The Companies sell their securities to the public. The company gets a capital boost when the people buy their company’s equity. And people get to reap the fortunes of the company proportional to their share holding. If all goes well, the relationship is mutually beneficial.

Types of IPO:

* Fixed Price Issue

* Book Building Issue

The initial price offer can be made through the fixed price issue or book building issue or a combination of both.

Fixed Price Issue

In the fixed price IPO process, the Company along with their underwriters evaluate the companies’ assets, liabilities, and every financial aspect. Then they work with these figures to fix a price per issue to achieve the target funds. This price which is fixed per issue is printed in the order document. The order document justifies the price with qualitative and quantitative factors. The demand for securities is known only after the issue is closed. The oversubscription levels are high in the fixed price offerings, sometimes several hundred times.

Book Building Issue

Compared to the developed countries, the concept of book building is new to India. In the book building issue, the price is discovered during the process of IPO. There is no fixed price, but there is a price band. The lowest price in the band is referred to as the ‘floor price’ and the highest price is referred to as the ‘cap price’.

The price band is printed in the order document. And the investors can bid for desired quantity of shares with the price which they would like to pay. Depending on the bids, the share price is decided. The securities are offered above or equal to the floor price. The demand is known everyday as the book is built.

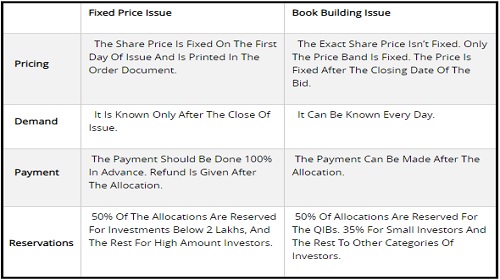

So, what are the differences between the issues?

The issues differ on these factors which are tabled as below.

The fixed price may undervalue the company’s shares at IPO. That price is more often than not, lower than the market value in a fair world. As a result these shares sell like hot cakes and investors positively revalue the company. As far as the company and its pre-IPO share holders are concerned, they may have given away a sizeable part.

Book building process is relatively more efficient. It matches the demand and supply of the shares the share price is fixed. There are no price leaks unlike the fixed price issue. Since the price which is fixed after the IPO closure, it works out to be mutually beneficial. The investor gets a potentially positive upside and company receives a fair return.

In fixed price issue the demand can have a cascading effect.

The book building process exposes the investor to larger vagueness.

Wrapping up

The number of fixed price issues is more than the book building issues. But the capital gathered from the book building issues are much more than the fixed price issues after the market price corrections. Book building issue is making a place for itself in the Indian Stock Markets. It is most widely used in case of mega issues.

Click here to open demat account With Angelbroking