We continue to remain bullish and construe this running correction as a healthy development - Angel One

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

Sensex (61932) / Nifty (18286)

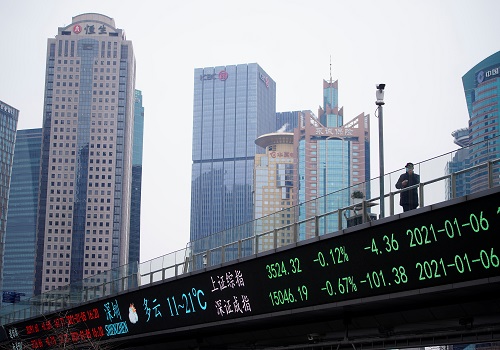

Our markets started the day on a promising note, but soon experienced profit booking as prices declined throughout the session, erasing Monday's gains. Unlike recent sessions, there was no significant rebound during the day as Nifty eventually ended with a loss of 0.61% tad below 18300.

In the past few weeks, the bulls had been enjoying a remarkable period, with intraday dips being quickly bought and prices consistently rising. However, yesterday, traders chose to secure their profits as key indices approached critical levels. As a result, a "Bearish Engulfing" pattern has emerged on the daily chart, which does not augur well for the bulls. The hourly chart also reveals a "Rising Channel," with prices ending just around the breakdown levels; making the initial hours of the upcoming session crucial. If weakness persists in the morning session, then further profit booking may push prices towards 18200 and then 18100 in the near term. Nevertheless, the overall sentiment remains strongly bullish, and any consolidation or short-term price correction should be viewed as a healthy part of the upward trend. On the other hand, the levels of 18400 to 18500 can now be considered as an immediate hurdle.

Nifty Bank Outlook (43904)

Banking has been the major charioteer in the recent run and on Monday, we saw it kissing the all-time high of 44151.80. Looking at Monday's strong close, the new high was imminent yesterday; but sluggish global cues and unfavorable piece of news flow for this space turned out to be a spoilsport. With some late correction, the BANKNIFTY ended the session a tad below the 44000 mark.

Yesterday, the benchmark index was sluggish right from the word go; but financial space managed to stay firm. However, in the latter half, this heavyweight space finally succumbed to the pressure to trim nearly four tenths of a percent from the previous close. Although, yesterday's close is not encouraging, we advise traders not to get carried away by such in between hiccups. Overall, we continue to remain bullish and construe this running correction as a healthy development. As far as levels are concerned, 43800 - 43500 are to be treated as immediate supports; whereas on the flipside, 44000 - 44150 are the levels to watch out for.

To Read Complete Report & Disclaimer Click Here

Please refer disclaimer at https://www.angelone.in/

SEBI Regn. No.: INZ000161534

Views express by all participants are for information & academic purpose only. Kindly read disclaimer before referring below views. Click Here For Disclaimer

Tag News

Quote on Silver : Silver price falls in recent weeks Says Prathamesh Mallya, Angel One

More News

Midday Review: Benchmarks continue to trade in fine fettle in afternoon deals