Wall Street jumps after strong factory data; Amex, Honeywell fall

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

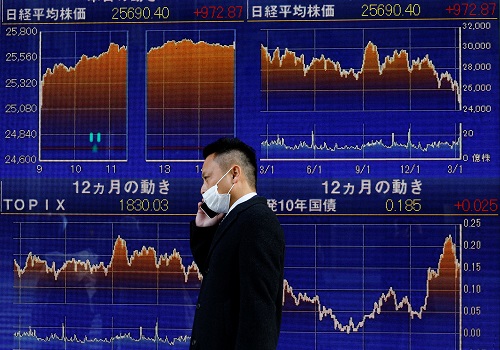

U.S. stock indexes jumped on Friday as a rise in factory activity in April supported bets of swifter economic recovery, while a fall in shares of American Express and Honeywell kept gains on the blue-chip Dow in check.

Data firm IHS Markit said its flash U.S. manufacturing PMI increased to 60.6 in the first half of this month, the highest reading since the series started in May 2007.

All the 11 major S&P 500 sectors were higher by early afternoon trading, with technology and financials leading gains.

Earnings reports in the day were lackluster, with American Express Co sliding 2.5% after reporting a slump in credit spending and lower quarterly revenue.

Honeywell International fell 2.4% after it missed revenue expectations for its aerospace division, its biggest business segment.

Wall Street's main indexes had slid nearly nearly 1% in the previous session following reports of U.S. President Joe Biden's plans to raise taxes on the wealthiest Americans, including the largest-ever increase in levies on investment gains.

"What we are seeing here is the market is attempting to rally after yesterday's decline, which I think was an aberration," said Peter Cardillo, chief market economist at Spartan Capital Securities in New York.

"Since the beginning of Biden's campaign, he has always talked about higher taxes. So, this is nothing new for the markets."

Analysts expect earnings from tech giants Apple Inc, Microsoft Corp, Amazon Inc and Facebook Inc next week to give markets some direction, after choppy trading for the most part of this week.

The benchmark S&P 500 and the Dow Jones Industrial Average are on course for weekly declines after four straight weeks of gains as the latest worries over tax hikes and a resurgence in global coronavirus cases dulled sentiment.

Speedy vaccination rollouts and trillions in dollars of economic stimulus have helped the S&P 500 and the Dow clinch all-time highs last week, with technology and other so-called growth names lagging cheaper value stocks that are expected to outperform as the economy re-opens after the pandemic shock.

At 12:03 p.m. ET, the Dow Jones Industrial Average was up 169.41 points, or 0.50%, at 33,985.31, the S&P 500 was up 41.22 points, or 1.00%, at 4,176.20 and the Nasdaq Composite was up 187.59 points, or 1.36%, at 14,006.01.

Naked Brand Group, jumped 6.1% after shareholders approved the proposed divestiture of the company's Bendon brick-and-mortar operations.

Image sharing company Pinterest Inc gained 2% as Credit Suisse raised price target, saying its newer product offerings and expanding footprint in markets abroad will yield higher revenue and user growth.

Advancing issues outnumbered decliners by a 3.65-to-1 ratio on the NYSE and by a 2.52-to-1 ratio on the Nasdaq. The S&P index recorded 54 new 52-week highs and no new low, while the Nasdaq recorded 71 new highs and 15 new lows.

320-x-100_uti_gold.jpg" alt="Advertisement">

320-x-100_uti_gold.jpg" alt="Advertisement">