Nifty opened lower with nearly 300 points due to massive overnight sell off in US bourses - Angel One

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

Sensex (52792) / Nifty (15809)

Yesterday’s opening was painful as Nifty opened lower with nearly 300 points due to massive overnight sell off in US bourses. This has certainly caught lot of momentum traders on the wrong foot who had carried over their longs after Tuesday’s sharp rebound. Barring negligible bounce in the initial trades, the index kept decelerating downwards to test the 15800 mark. But fortunately, there was no major damage seen during the day as compared to the global screen. Eventually, the tragic weekly expiry day ended with over two and half a percent cut to the previous close. Honestly speaking, yesterday’s gap down opening was completely out of syllabus thing for most of the market participants, including us. In fact, all the pre-market strategies went for a toss as Nifty opened convincingly below the strong psychological support of 16000. Now we are once again very much closer to the crucial support zone of 15740 – 15650. Whether we are going to break this and fall below it or not, the time will tell and importantly, it depends on how things pan out globally over the next couple of sessions. Similar to last Friday, we are still hopeful on holding on to this support. But if this has to happen, we need to have some solid trigger on the global front, which will help our market defend this zone.

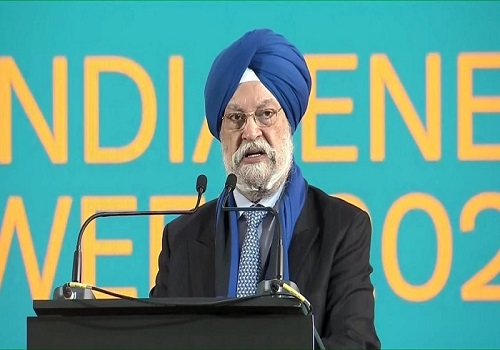

Exhibit 1: Nifty Daily Chart

Nifty Bank Outlook - (33316)

Bank Nifty as well started with a massive gap down opening and with no significant intraday bounce continued to creep lower throughout the session to eventually end with a loss of around 2.50% at 33316. Looking at the decent bounce of the initial part of the week and placement of RSI smoothed on the daily chart we were of a view that the current bounce may extend in the near term however the mayhem seen across the global financial markets spilled water on this expectation. With yesterday's sell-off prices are back to key support levels around the 33000 levels and the oscillators are still in the oversold zone. It would be crucial to see how markets react around this make or break level; if they slip below it then further weakness can be seen towards the March swing low of 32000 - 32200 levels. On the flip side, it would be a daunting task for the bulls to reclaim yesterday's lost ground and the bearish gap zone between 33600 - 34200 is likely to act as resistance. Volatility is likely to remain high and traders are advised to avoid undue risk.

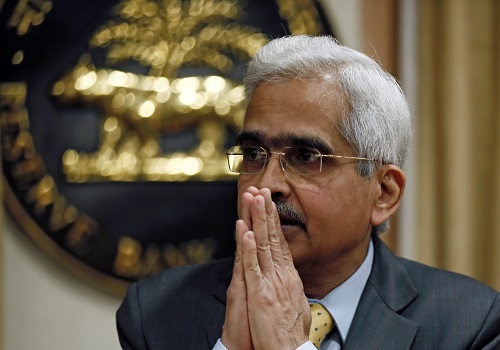

Exhibit 2: Nifty Bank Daily Chart

To Read Complete Report & Disclaimer Click Here

Please refer disclaimer at https://www.angelone.in/

SEBI Regn. No.: INZ000161534

Views express by all participants are for information & academic purpose only. Kindly read disclaimer before referring below views. Click Here For Disclaimer

Tag News

Quote on Silver : Silver price falls in recent weeks Says Prathamesh Mallya, Angel One

More News

The performance of the global indices and crude movement will remain in focus - Religare Bro...