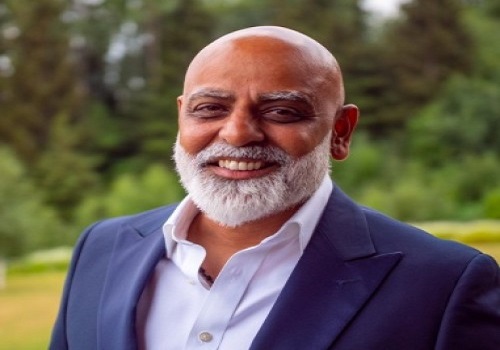

View on RBI Monetary Policy By Mr. Amar Ambani, YES Securities

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

Below are Views on RBI Monetary Policy by Mr. Amar Ambani, Senior President and Head of Institutional Equities, YES Securities.

“Though a status quo on the repo rate was in line with the market expectations, no move on the reverse repo was not what the money markets were pricing in. Yields in the money markets have been firming up, given that variable reverse repo auctions are being conducted at rates proximal to 4%. The status quo on the reverse repo is construed to be dovish. The central bank justified the status quo given the emerging uncertainty over the new COVID variant and lagging private investments. RBI is sticking with a tailored policy stance that balances growth and inflation. Meanwhile, RBI will continue to absorb excess liquidity in a non-disruptive manner, primarily through variable reverse repo auctions. On the demand side, RBI reckons frequency indicators portends traction in consumption, though it needs to sustain and needs policy support. Govt spending will provide support to aggregate demand. On projections, FY22 GDP growth is retained at 9.5%, while Headline CPI inflation is seen peaking in Q4 FY22 and then softening thereafter. CPI average of 5.3% is seen for FY22, falling to 5% in Q1 and Q2 FY23.

On the interest rate trajectory, we see that RBI has simply kicked the can down the road in terms of normalizing the LAF window. It seems that RBI is content with the fact that VRRR auctions have been efficacious in absorbing excess liquidity and do not want to tinker much with the policy rates now given the nascent economic recovery and still looming uncertainty of the pandemic. We think the normalization of the LAF window is now subject to the durability of the economic recovery and mitigation of the pandemic uncertainty. Meanwhile, normalization of the repo rate is completely ruled out till most of the H1 FY23.”

Above views are of the author and not of the website kindly read disclaimer

Tag News

Sensex hits an all-time High By Mr. Amar Ambani, Yes Securities

320-x-100_uti_gold.jpg" alt="Advertisement">

320-x-100_uti_gold.jpg" alt="Advertisement">