USDINR pair is expected to trade with a negative bias - Religare Broking

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

Key Highlights

* The USDINR futures yesterday since opening faced significant selling pressure and traded on a negative note the entire day. It shed around 0.54% or appx. 23 thousand contracts as Open Interest during the day. The levels of 82.60 played key resistance during yesterday's trade.

* PCR-OI for the June series inched higher to 0.83 vs 0.82 in the previous session.

* The Dollar Index traded on a negative note after it failed to sustain above the key hurdle of 104.50-105.60. It ended the day at 103.50. The levels of 103.30 will play key support onwards.

* Crude Oil prices found support at $72 during yesterday's trade. It ended the day at $74 higher by around 3%.

USDINR Outlook

USDINR pair is expected to trade with a negative bias.

Key Resistance around 82.55 mark (Spot)

Key Levels (June Fut)

Support: 82.30/82.20

Resistance: 82.60/82.70

To Read Complete Report & Disclaimer Click Here

Please refer disclaimer at https://www.religareonline.com/disclaimer

SEBI Registration number is INZ000174330

Views express by all participants are for information & academic purpose only. Kindly read disclaimer before referring below views. Click Here For Disclaimer

Tag News

EURINR trading range for the day is 89.13 - 89.49. - Kedia Advisory

More News

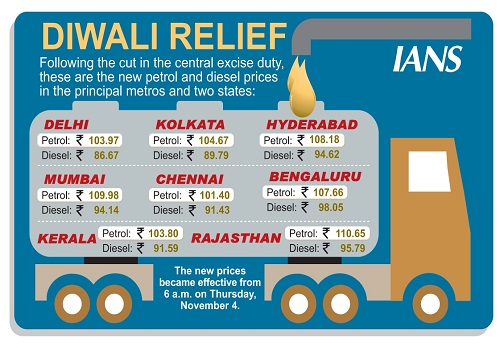

Perspective note on rupee 03 November 2021 By Emkay Global Financial Services

320-x-100_uti_gold.jpg" alt="Advertisement">

320-x-100_uti_gold.jpg" alt="Advertisement">