USDINR opened on a negative note and traded in a 10 odd paisa range - Axis Securities

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

USD/INR

Lack of driving forces put the US Dollar in a tight range. To add to it, the traders avoided speculation ahead of the RBI policy. On Wednesday, USDINR opened on a negative note and traded in a 10 odd paisa range. On the daily chart we can see the pair formed an inside candle, indicating lack of momentum in the pair. The RSI plotted on the daily chart can be seen flattening near the overbought level, indicating exhaustion in the bullish momentum in the pair. In the sessions to come, we can expect the pair to face rejection near the 83.00. On the downside the immediate support is placed near the 82.50, if we see a break below the 82.50 we might see it head lower towards the 82.20 and 82.00

EUR/INR

The US Dollar trading in a tight range pushed the Euro in a range. The EURINR pair moved in a 20 odd paisa range after a flattish open. On the daily chart we can see that the EURINR has been forming small candle since the past three sessions, indicating lack of momentum and trend in the pair. The RSI plotted on the daily chart can be seen forming a bullish hinge, indicating increasing bullish momentum in the pair Going by the price action, the pair is expected to face resistance near the 91.30 level. On the downside the immediate support is placed near the 90.80 mark.

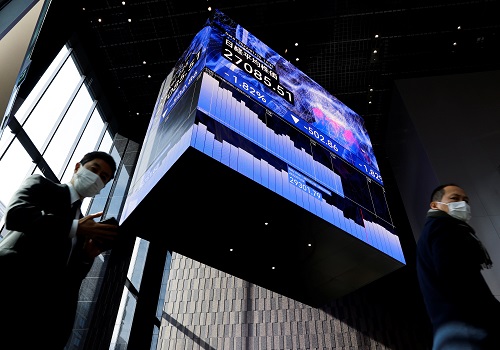

JPY/INR

The USDJPY pair seems to be finding resistance around the 143.00 zone despite the Dollar index inching higher. On Wednesday the JPYINR pair opened on a slightly negative note and traded in a range through the day. The RSI plotted on the daily chart, can be seen moving lower towards the oversold zone, indicating bearish momentum in the pair. In the sessions to come we might see the pair find resistance near the 58.30 and 58.60 zone. On the downside the 57.80 followed by 57.50 is expected to act as a support.

GBP/INR

The GBPINR pair opened on a slightly positive note and made a rally towards the 106.00 mark in the first half of the session. In the second half, the pair lost all of its gains and moved lower towards the 105.50 zone. On the daily chart we can see the pair forming small bodied candles with long upper wicks since the past two session, indicating that the pair has been facing string rejection near the 106.00 mark. The RSI plotted on the daily chart can be seen flattening near the 50 mark, indicating lack of momentum in the pair. The price action suggests that the 105.00- 104.90 zone could act as a support in the sessions to come. On the upside we need to keep a close watch on the 105.80-106.00 mark, as a resistance.

To Read Complete Report & Disclaimer Click Here

For More Axis Securities Disclaimer https://simplehai.axisdirect.in/disclaimer-home

SEBI Registration number is INZ000161633

Views express by all participants are for information & academic purpose only. Kindly read disclaimer before referring below views. Click Here For Disclaimer

More News

USD/INR is trading above 20 and 50 day moving average Buy on rise near 82.68 for tgt of 82.9...

320-x-100_uti_gold.jpg" alt="Advertisement">

320-x-100_uti_gold.jpg" alt="Advertisement">