USDINR October futures took support near the 13-day exponential moving average - HDFC Securities

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

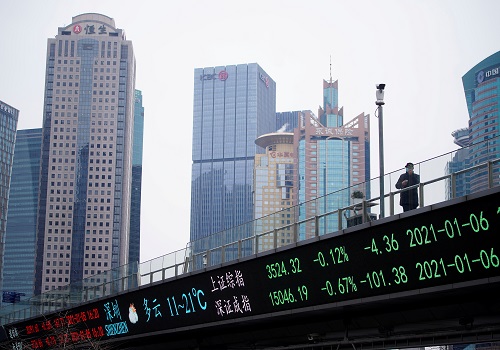

Haven Currency Slips as Shares Rise

Indian rupee is expected to open slightly higher following the overnight fall in the dollar index and gain in risk assets. The local unit has been trading in a tight range for the last seven days amid central bank intervention all the front. Currencies volumes were modest with most pairs holding too tight ranges in the US session. The forward markets indicate spot USDINR could open around 82.25. The USD/INR 1-year forward implied yield dropped to 2.45%, its lowest since November 2011, from2.55%on Friday.

On Tuesday, spot USDINR ended flat at 82.36, after touching an intraday low of 82.03. Technical setup still remains bullish for the pair amid the formation of a flat pattern on the daily chart. The pair is having support at 82 and resistance at 82.70.

Asian stocks had a mixed open on Wednesday as traders assessed a solid start to the corporate-earningsseason that helped extend a rally in US markets.

USD/CNH is on a path beyond the record high of 7.2674 as shorting the yuan is relatively cheap, even on a 2-year time horizon. The Fed may not pause rate hikes even at 4.5% if inflation hasn’t peaked. Meanwhile, Chinese President Xi Jinping appears to have a list of priorities which may not bring a quick turnaround for the economy and the yuan.

The yen crept higher in early Wednesday trade after dropping to a new 32-year low on Tuesday. Finance Minister Shunichi Suzuki tells reporters he is increasing the frequency of monitoring FX markets.

US President Joe Biden will announce a plan on Wednesday to release 15 million barrels from US emergency oil reserves and may consider significantly more this winter, in an effortto ease high gasoline prices.

Technical Observations:

USDINR October futures took support near the 13-day exponential moving average.

It has support around 82.10 and resistance at 82.80.

Momentum oscillator, Relative Strength Index of 14 days period flattened at overbought zone.

MACD has given a negative cross over and histogram bars also flattened on the daily chart indicating a sideways trend

The aggerate open interest rose while in the near month future open interest declined which suggests traders rolling over their position ahead of holiday shortened week.

USDINR Oct. fut. Is expected to trade in the range of 82 to 82.80 with a bullish bias

USDINR October Futures Daily Chart

To Read Complete Report & Disclaimer Click Here

Please refer disclaimer at https://www.hdfcsec.com/article/disclaimer-1795

SEBI Registration number is INZ000171337

Views express by all participants are for information & academic purpose only. Kindly read disclaimer before referring below views. Click Here For Disclaimer

Top News

Godrej Properties inches up on targeting at least 27% growth in sales bookings this fiscal year

Tag News

EURINR trading range for the day is 89.13 - 89.49. - Kedia Advisory

More News

The EUR/INR futures pair has support at 80.70 levels whereas resistance is placed at 81.20 l...

320-x-100_uti_gold.jpg" alt="Advertisement">

320-x-100_uti_gold.jpg" alt="Advertisement">