USDINR May futures expected to open lower as it breaks the recent low - HDFC Securities

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

Dollar plunges as FOMC remains dovish - HDFC Securities

Dollar plunges after Federal Reserve Chair Jerome Powell and his colleagues upgraded their assessment of the U.S. economy but said they were not yet ready to consider scaling back pandemic support. FOMC held key interest rate near zero and maintaining a $120 billion monthly pace of asset purchases. The central bank’s reiteration that inflation pressures are likely “transitory” helped Treasuries rally.

Rupee to benefit from spillover from a short squeeze in its bond markets, as investors looked to re-enter the market despite continuing poor Covid-19 news. Waning demand for the haven of the U.S. dollar helped push rupee higher in today’s trade. Market also expecting foreign fund inflows from reliance deal which may add gains in rupee.

On Wednesday, spot USDINR closed at 74.37, down 30 paise or 0.40%, marking third consecutive daily gains. Technically, the pair has support at 73.90 and resistance at 74.70. The bias for today remains on down side following risk-on sentiments and weaker dollar index.b

Indian sovereign bond were largely resilient on Wednesday, with the yield on benchmark 10- year bond steady at 6.05%. It has declined 13 basis points this month.

The dollar was on the back foot near nine-week lows today after dovish outlook by Fed which gave green light for the global reflation trade. It pushed euro to cross major trendline resistance at $1.2114 and power up to the highest since late February at 1.2135, opened the way to bull targets of $1.2196 and $1.2242. Dollar expected to trade left as US President Joe Biden unveiled plans for a $1.9 trillion stimulus package that Biden called “one of the most consequential rescue packages in American history.”

The pound rises over the greenback on buying by fast money funds as a deal for Aon’s acquisition of Willis Towers Watson for $30b draws closer

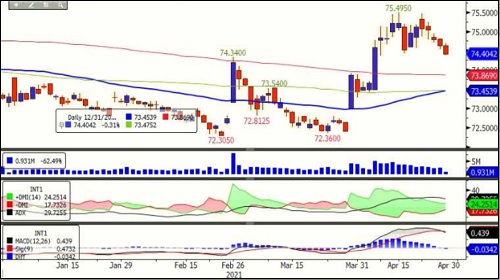

USDINRb

USDINR May futures expected to open lower as it breaks the recent low, confirming double top. The double top pattern target comes at 73.45, that is coincide with 50 and 100 Days simple moving average.

Momentum oscillators and indicators on daily chart turned weak indicating further weakness in pair.

USDINR May futures is expected to head towards 73.87 level in coming day while continue to resist at 75

To Read Complete Report & Disclaimer Click Here

Please refer disclaimer at https://www.hdfcsec.com/article/disclaimer-1795

SEBI Registration number is INZ000171337

Views express by all participants are for information & academic purpose only. Kindly read disclaimer before referring below views. Click Here For Disclaimer

Tag News

EURINR trading range for the day is 89.13 - 89.49. - Kedia Advisory