USDINR January futures formed bearish candle and closed below Doji candlestick pattern suggesting further weakness - HDFC Securities

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

Rupee Likely To Open Lower On Risk-off Moods - HDFC Securities

Indian rupee expected to open steady in line with other Asian currencies. On Thursday, Rupee caught another bid by logging its third green finish in last four days moving closer to a month high. The weaker dollar index, stronger foreign fund inflows, higher equities and recovery in local economy altogether braced rupee higher. Technically, the bias for the rupee remains bullish with immediate resistance at 72.75 and support at 73.50.

The dollar fell and lagged most of its peers, while the euro erased losses after sliding to the lowest level in a month.

Asian stocks looked set for a muted start. U.S. equity futures edged higher and Treasury contracts were steady as investors scrutinized President-elect Joe Biden’s $1.9 trillion Covid19 relief plan.

President-elect Joe Biden will ask Congress for $1.9 trillion to fund immediate relief for the pandemic-wracked U.S., in the face of a split Senate and a deteriorating economy. Meanwhile, a day after the House impeached President Donald Trump for a second time, there is still little clarity on when his trial would take place or what form it would take.

Federal Reserve Chair Jerome Powell said policy makers won’t raise interest rates unless they see troubling signs of inflation also weighed on dollar.

U.K. Prime Minister Boris Johnson is facing a threat to his leadership from Conservative lawmakers who are demanding a clear plan out of an economically damaging third pandemic lockdown.

A second straight weekly decline left US Reserve Bank Credit at $7.28 trillion, as interest bearing assets at the Fed slipped $25 billion sequentially and $69 billion from two weeks ago.

USDINR

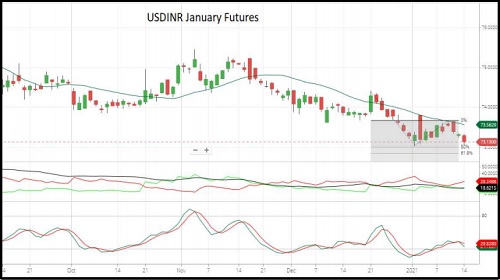

USDINR January futures formed bearish candle and closed below Doji candlestick pattern suggesting further weakness.

The pair has tough resistance at 20 DMA.

The pair is having support at 73 and 72.80, the 50% and 61.8% Fibonacci Extension adjoining recent swing high and low.

Momentum oscillator, stochastic given negative crossover and heading towards oversold zone.

The bias for USDINR January futures remains bearish with downside target of 73 and 72.80 while crossing of 73.60 will negate the view.

To Read Complete Report & Disclaimer Click Here

Please refer disclaimer at https://www.hdfcsec.com/article/disclaimer-1795

SEBI Registration number is INZ000171337

Views express by all participants are for information & academic purpose only. Kindly read disclaimer before referring below views. Click Here For Disclaimer

Tag News

EURINR trading range for the day is 89.13 - 89.49. - Kedia Advisory

More News

USDINR ended 6 paise down at 72.75 yesterday - Geojit Financial

320-x-100_uti_gold.jpg" alt="Advertisement">

320-x-100_uti_gold.jpg" alt="Advertisement">