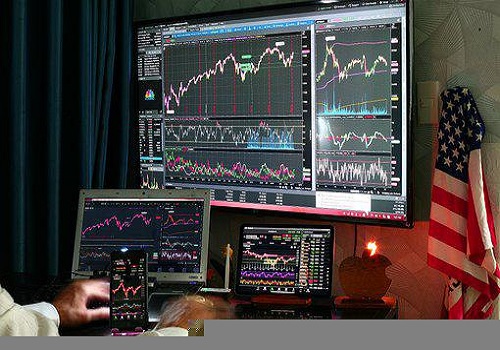

US markets end in red as consumer price growth exceeds estimates

The US markets ended in red on Wednesday, magnifying their recent session’s losses as a Labor Department report showing a bigger than expected increase in US consumer prices added to concerns about the outlook for interest rates. The Labor Department said its consumer price index shot up by 1.3 percent in June after jumping by 1.0 percent in May. Street had expected consumer prices to leap by 1.1 percent. With the bigger than expected monthly surge, the annual rate of consumer price growth accelerated to 9.1 percent in June, reflecting the biggest increase since November 1981. Street had expected the annual rate of consumer price growth to accelerate to 8.8 percent in June from 8.6 percent in May. Excluding increases in prices for food and energy, core consumer prices advanced by 0.7 percent in June after climbing by 0.6 percent in May. Core prices were expected to rise by another 0.6 percent.

While the annual rate of core consumer price growth slowed to 5.9 percent in June from 6.0 percent in May, the rate of growth was expected to decelerate to 5.7 percent. The bigger than expected jump in consumer prices has solidified expectations the Federal Reserve will raise interest rates by 75 basis points later this month and increases the likelihood of another 75 basis point rate hike in September. Traders continued to express concerns the Fed’s aggressive fight to contain elevated inflation will inadvertently push the economy into a recession. On the sectoral front, Considerable strength emerged among steel stocks, as reflected by the 1.5 percent gain posted by the NYSE Arca Steel Index. However, banking stocks showed a significant move to the downside on the day, dragging the KBW Bank Index down by 1.5 percent.

Dow Jones Industrial Average fell 208.54 points or 0.67 percent to 30,772.79, Nasdaq dropped 17.15 points or 0.15 percent to 11,247.58 and S&P 500 was down by 17.02 points or 0.45 percent to 3,801.78.