US dollar increased marginally by 0.01% amid a decline in domestic market and surge in US treasury yields - ICICI Direct

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

Rupee Outlook and Strategy

US dollar increased marginally by 0.01% amid a decline in domestic market and surge in US treasury yields. However, further upside was capped on weaker-than-expected economic data from country. US CB Consumer Confidence data showed that consumer confidence deteriorated in August 2021

Rupee future maturing on September 28 appreciated by 0.47% in yesterday’s trading session on weakness in dollar, FII inflows and optimistic domestic market sentiments

The rupee is expected to trade with a positive bias on rise in risk appetite in the global markets, weakness in dollar and FII inflows. However, sharp gains may be prevented on concerns over uptick in daily Covid-19 cases in India. Further, traders will remain cautious ahead of US jobs data for insight into the possible path of US Fed monetary policy and Opec meeting. US$INR (September) is likely to trade between at 73.0-73.40

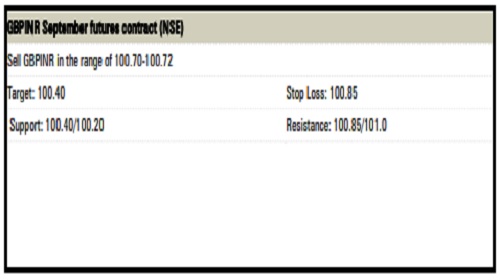

GBPINR Strategy

To Read Complete Report & Disclaimer Click Here

https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

Views express by all participants are for information & academic purpose only. Kindly read disclaimer before referring below views. Click Here For Disclaimer

Top News

FDI in manufacturing sector jumps 76% to worth $21.34 billion in 2021-22: Commerce Ministry

Tag News

EURINR trading range for the day is 89.13 - 89.49. - Kedia Advisory