The rupee is expected to depreciate today amid strong dollar and risk aversion in the global markets - ICICI Direct

Rupee Outlook and Strategy

• The US dollar advanced ahead of inflation data that could provide some hint on Fed’s monetary policy path. Further, hawkish statements from multiple Fed officials supported dollar. Fed officials signalled the need for 50 bps hike at the next couple of meetings. Also, demand for dollar increased on worries over slowing global economic growth due to war in Ukraine and resurgence of Covid-19 cases in China

• Rupee future maturing on May 27 appreciated by 0.28% amid decline in crude oil prices. However, sharp gains were prevented on strong dollar and pessimistic global markets sentiments

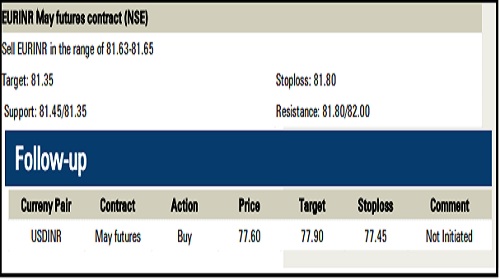

• The rupee is expected to depreciate today amid strong dollar and risk aversion in the global markets. Further, persistent FII outflows on worries over slowing global economic growth and rising interest rates across major countries will hurt Rupee. Additionally, markets will remain vigilant ahead of inflation data from US to get clues on how aggressive the Fed will be in tightening policy. US$INR (May) is expected to trade in a range of 77.25-77.75

To Read Complete Report & Disclaimer Click Here

https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

Above views are of the author and not of the website kindly read disclaimer