U.S. dollar advances before Fed decision; Swedish hike fails to boost crown

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

The dollar ascended close to a two-decade high on Tuesday, as investors geared up for another aggressive interest rate hike from the Federal Reserve, the main focus in a week packed with central bank meetings.

The Fed started a two-day meeting on Tuesday, with rate futures traders pricing in an 83% chance of a 75 basis-point hike and a 17% probability of a 100 bps of tightening.

The dollar index was on track for its fifth weekly gain in six and was last up 0.5% at 110.10 <=USD>, just below a more than 20-year high of 110.79 touched earlier this month.

So far this year, the dollar has soared roughly 15%, on pace for its largest yearly percentage gain in 41 years.

"It's difficult to see the top for the dollar at the moment. Short-term forces are driving demand for the dollar: the combination of weak risk sentiment, fears of global recession, a hawkish Fed, and the war in Ukraine," said Vassili Serebriakov, FX strategist, at UBS in New York.

"The dollar will turn lower once U.S. inflation peaks and global economy bottoms, but we're not there yet," he added.

Also on Tuesday, Sweden's central bank raised rates by a full percentage point. The rate hike by the Riksbank was larger than analysts had expected, causing the Swedish crown to briefly spike against the euro and dollar.

But it failed to retain that strength. The euro extended recent gains, climbing to a fresh six-month top of 10.8808 crowns. The euro was last up 0.6% at 10.8630. The dollar also climbed 0.6% to 10.8994 crowns.

"In a way, this was an attempt by the Riksbank to lift the krona, but it failed, and it's not surprising," said Francesco Pesole, currency strategist at ING.

He said the relationship between European currencies and central bank policies had been breaking down as markets increasingly traded on Europe's energy and growth outlook instead.

Providing additional support to the dollar, the U.S. two-year Treasury yield, which is sensitive to rate policy expectations, rose as high as 3.992%, its highest since November 2007.

The euro slid 0.6% to $0.9966, after dropping as low as $0.9864 on Sept. 6 for the first time in two decades.

Europe's single currency failed to get a boost even after European Central Bank President Christine Lagarde said the bank may need to raise rates to a level that restricts economic growth to cool demand and combat unacceptably high inflation.

The beaten-down sterling fell 0.5% to $1.1385.

The Bank of England will decide on rate policy on Thursday, and investors are split over whether a 50 or 75 bps hike is on the way.

The Bank of Japan also meets this week but is widely expected to keep its ultra-easy stimulus settings unchanged - including pinning the 10-year yield near zero - to support a fragile economic recovery.

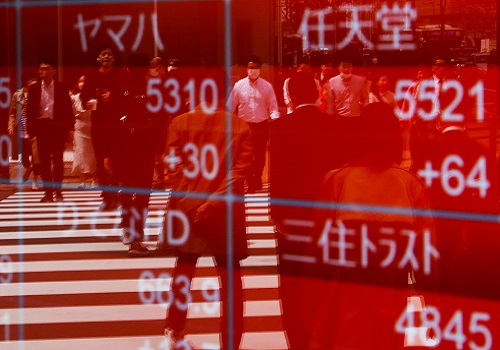

The yen has slumped this year due to this policy and the dollar was last up 0.4% on the Japanese currency at 143.78, continuing a week-long consolidation after climbing as high as 144.99 on Sept. 7 for the first time in 24 years.

The Japanese currency has plunged nearly 20% against the dollar so far in 2022.

========================================================

Currency bid prices at 3:58PM (1958 GMT)

Description RIC Last U.S. Close Pct Change YTD Pct High Bid Low Bid

Previous Change

Session

Dollar index 110.1300 109.5400 +0.54% 15.123% +110.2900 +109.3500

Euro/Dollar $0.9976 $1.0025 -0.49% -12.25% +$1.0051 +$0.9956

Dollar/Yen 143.6750 143.2000 +0.34% +24.81% +143.9150 +142.9350

Euro/Yen 143.32 143.52 -0.14% +9.98% +144.0300 +143.0300

Dollar/Swiss 0.9641 0.9647 -0.06% +5.70% +0.9682 +0.9624

Sterling/Dollar $1.1383 $1.1434 -0.45% -15.84% +$1.1460 +$1.1358

Dollar/Canadian 1.3360 1.3251 +0.83% +5.67% +1.3375 +1.3228

Aussie/Dollar $0.6692 $0.6727 -0.50% -7.92% +$0.6747 +$0.6677

Euro/Swiss 0.9615 0.9667 -0.54% -7.27% +0.9682 +0.9604

Euro/Sterling 0.8763 0.8765 -0.02% +4.32% +0.8784 +0.8725

NZ $0.5899 $0.5957 -0.96% -13.80% +$0.5975 +$0.5887

Dollar/Dollar

Dollar/Norway 10.3210 10.2285 +1.17% +17.46% +10.3570 +10.2035

Euro/Norway 10.3001 10.2043 +0.94% +2.87% +10.3215 +10.2296

Dollar/Sweden 10.8799 10.7623 +0.55% +20.65% +10.9189 +10.6828

Euro/Sweden 10.8552 10.7955 +0.55% +6.03% +10.8808 +10.7572