U.S Fed Rate Hike expected to have a negative impact on Gold, but positive influence on Dollar : Motilal Oswal Financial Services Limited

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

Fed walking on a tight rope

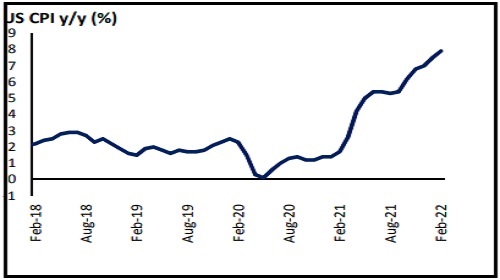

The Federal Reserve in the past has consistently been of the view that ‘Inflation was transitory” but rally in global crude oil and base metals doesn’t build a case for the same. Higher food and oil prices as a result of Russia’s invasion of Ukraine has sent U.S. inflation to the highest annual level in last 40 years. Survey suggests that average annual CPI is forecast to rise 5.1% in 2022 after increasing at a 4.7% pace last year. In his testimony, the Fed Chairman, confirmed his support for a quarter-point rate rise at the central bank’s March meeting as he laid out the case for tightening monetary policy amid heightened geopolitical tensions. Alongside plans to raise rates, the Fed will also begin scaling back its $9tn balance sheet. But investors will now be looking at how rally in base metals and energy price could be impacting the overall inflation.

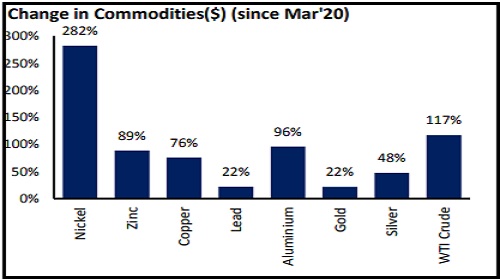

Change in Commodities($) (since Mar'20)

Super rally in commodities

Global commodity prices have witnessed one of the best rallies in more than 50 years, wherein since March’2020 in the base metal complex except lead prices for other metals have on an average moved by ~70%. In the energy complex crude has almost run up by over 10 times after falling to negative and natural gas by over 2 times. In case of precious metals, gold and silver too have risen sharply and both gold and silver by given return by ~25% to ~50% respectively. Events in Russia and Ukraine are unleashing exceptional commodity price moves, which could have structural implications on long-term supply.

Base metals have surged sharply in the last few sessions with nickel has been an outperformer with over ~100% YTD gains. The underlying tone has been bullish, with massive demand coming from Steel Mfg. and EV battery makers. Inventories in both LME and Shanghai warehouse are quite shallow supporting prices. Nickel, which is also used in the batteries that power electric vehicles recently hit an 11-year high as stockpiles have dwindled at the London Metal Exchange due to strong demand from automakers. An intensification of sanctions on Moscow following its invasion of Ukraine could push prices higher. Russia is a large producer of nickel as well as copper and cobalt. Copper, used in wind turbines and power grids, hit a record high above $10,500 a tonne last year and has doubled since the depths of pandemic. Cobalt, a common byproduct of copper mining, has climbed more than 40% over the past six months. Not everyone is convinced that metals are set for a new super cycle. The growth of renewable energy and electrical vehicles will boost demand for metals but that could be offset by a contraction in demand from China, still the world’s biggest consumer of raw materials

Oil prices have surged from levels by approximately 30-40% in the last one month after Russia invaded Ukraine and supply constrains build up sharp risk premium in prices. In the middle of rally, there were reports suggesting that there could be a global agreement to release crude reserves but failed talks further led to upside move. Prices got further boost after the US President Biden announced a ban on Russian oil and other energy imports in retaliation for the invasion of Ukraine. This means Russian oil will no longer be acceptable in U.S. ports.

Inflation a major concern

Until the start of the 2022 most investors for that matter most central bank head’s were of the view that inflation is transitory. But the question now is that is inflation driven by pandemic or broad based. Pandemic inflation anomalies are settling down. In month-over-month terms, used car prices dipped. Durable goods inflation decelerated sharply last month. US consumer price growth approached 8% last month ahead of a surge in energy prices following Russia’s invasion of Ukraine, raising pressure on the Federal Reserve to more substantively tighten monetary policy. The latest report captures the period just before Russia launched a full-scale attack on Ukraine and western allies unveiled among the most punitive financial penalties ever levied on a country, including a US ban on Russian energy imports.

The Fed is set to proceed with a quarter-point interest rate this month, and will then seek to move the federal funds rate closer to a level that neither aids nor constrains economic activity. Investors are also factoring in a hit from higher commodity costs as consumers and businesses face higher energy bills. Coupled with tighter policy from the Fed, which is expected to raise borrowing costs for companies and individuals, the speed of the US economic recovery could slow. That means the Fed is walking a tightrope, given the central bank is reluctant to push the country into recession even as it attempts to bring down inflation.

To Read Complete Report & Disclaimer Click Here

For More Motilal Oswal Securities Ltd Disclaimer http://onlinetrade.motilaloswal.com/emailers/Disclaimer3.html SEBI Registration number is INH000000412

Views express by all participants are for information & academic purpose only. Kindly read disclaimer before referring below views. Click Here For Disclaimer

Tag News

EURINR trading range for the day is 89.13 - 89.49. - Kedia Advisory

320-x-100_uti_gold.jpg" alt="Advertisement">

320-x-100_uti_gold.jpg" alt="Advertisement">