Turkey further cuts rates, lira dips to new record low

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

The Turkish central bank lowered interest rates for the third successive month despite high inflation, causing the embattled national currency lira to sink to new historic lows against the US dollar.

The Monetary Policy Committee (MPC) of the bank decided during a key meeting to lower the benchmark interest rate to 15 per cent with a cut of 100 basis points.

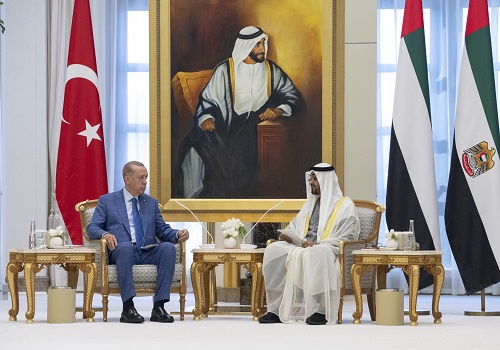

The bank has previously lowered rates by 300 basis points since August, in line with Turkey's President Recep Tayyip Erdogan's belief that higher interest rates result in higher prices, Xinhua news agency reported.

On Wednesday, ahead of the MPC meeting, Erdogan reiterated his hostility to high rates, vowing in the Parliament that he would battle it "until the end." Meanwhile, he also vowed to take measures to protect the low-income groups in the face of rising living costs.

Following the MPC's decision of cutting rate, Turkish lira dipped to a fresh record low of 11.2 against the greenback.

The lira suffered one of its biggest falls of the year on Tuesday, losing about 4 per cent against the dollar, and traded at 10.45 per dollar, four days after it passed the physiological mark of 10 per dollar.

Turkey's large short-term external debts and low foreign currency reserves mean that it is one of the most vulnerable emerging markets to tighter external financing conditions.

"In the upcoming 12 months period, Turkey has to repay (external) debts amounting to $167 billion, thus it needs foreign currency... in this context, the lira will not be returning to former levels," independent Economist Mustafa Sonmez told Xinhua.

Many big companies have euro or dollar-denominated loans, and their repayment in the coming months may pose problems with the devaluation of the Turkish currency, analysts warned.

The inflation, which is under 20 per cent annually, the highest rate in years, is causing price increases which in turn results in higher costs for imports, fuel and basic household goods, all of which are now much more expensive.

With the arrival of winter, "the rise in global oil and natural gas prices also increases Turkey's energy bill," said Enver Erkan, Chief Economist at Istanbul's Tera Securities.

Erkan said in a note to investors that the rise in energy bills will in turn increase inflation, giving rise to a vicious circle for households.

During his 19-year rule, Erdogan had offered economic stability to Turks until a currency meltdown in 2018, which resulted in high inflation and unemployment.

The lira has lost 30 per cent of its value since the start of 2021. It has been put under further strain by concerns that the US Federal Reserve may raise interest rates sooner than expected.

In a supermarket in the capital city Ankara's Hilal neighbourhood, young employee Hamit Tekin told Xinhua that he is busy changing price tags on food items the recent days because of the successive price hikes.

"For me, it's my job, but for clients, it's a very real burden. Consumers complain about the price hike and the difficulties of making ends meet," he added.

320-x-100_uti_gold.jpg" alt="Advertisement">

320-x-100_uti_gold.jpg" alt="Advertisement">