This has impacted bond and currency markets with the US 10-year yield rising above 4% Says Dr. V K Vijayakumar, Geojit Financial Services

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

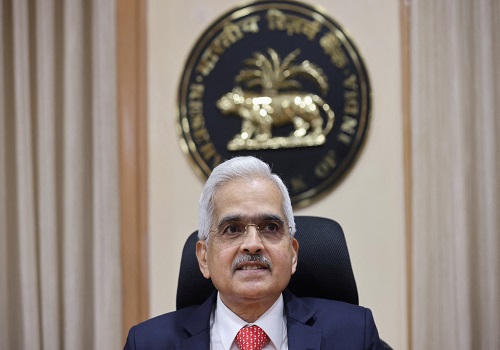

Quote On Morning Market 02 August 2023 By Dr. V K Vijayakumar, Chief Investment Strategist at Geojit Financial Services

The major news after market close yesterday is the rating agency Fitch’s downgrade of US sovereign rating from AAA to AA+. This has impacted bond and currency markets with the US 10-year yield rising above 4%. Paradoxically, during uncertainties dollar’s safe haven status improves even when when the downgrade is that of the US credit rating. This has happened in the past also.

The impact on the stock markets is likely to be negative but not large since the US economy is now headed for a soft landing and not a recession, as markets feared earlier.

US 10-year yield rising above 4% and the dollar index appreciating to 102 are negative for emerging markets. Also, indicators like PMI from the Euro Zone and China suggest slowdown in these economies. In brief, the economic backdrop is negative. Investors may wait and watch for the dust to settle before jumping to buy on dips.

Above views are of the author and not of the website kindly read disclaimer

Tag News

Weekly Market Analysis : Markets strengthened recovery and gained nearly 2% in the passing w...