The rupee remained almost flat for the day after movement was seen on both sides - ICICI Direct

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

INR Futures

* The rupee remained almost flat for the day after movement was seen on both sides. The rupee managed to appreciate almost 3 paise against the US dollar and ended near 72.51 levels

* The dollar index on Friday posted modest gains on higher-note yields. EUR/US$ fell back slightly on concern about the third wave of Covid infections spreading through Europe

Global Bonds

* The Nifty opened lower on the back of negative global cues but found support and recovered. Sectorally, FMCG and metal led the up move along with Reliance Industries while the realty space was the only exception, which closed in the red. According to options data, the highest Put base of 14500 strike is likely to keep downsides restricted

* On Friday, the Bank Nifty started the day on a weak note but overturned selling pressure and gained strength as the day progressed. Healthy buying was seen in PSU banks compared to private counterparts

FII & FPI Activities

* Foreign institutional investors (FII) remained net buyer to the tune of | 1005 crore on March 18. They bought worth | 1314 crore in the equity market and sold worth | 309 crore in the debt market

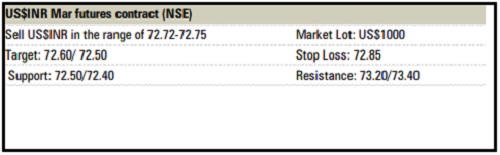

US$INR futures on NSE

* The US$INR pair continue to appreciate as the dollar index remained below 92. However, a rise in US yields would push the Dollar index above 92, which would move the US$INR pair higher. However, a rise should be used to create fresh shorts

* The dollar-rupee March contract on the NSE was at | 72.58 in the last session. The open interest fell by almost 0.32% for the March series

US$INR Strategy

To Read Complete Report & Disclaimer Click Here

https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

Views express by all participants are for information & academic purpose only. Kindly read disclaimer before referring below views. Click Here For Disclaimer

Top News

Fall in share of food in rural consumption basket indirectly indicates uptick in rural income

Tag News

EURINR trading range for the day is 89.13 - 89.49. - Kedia Advisory

320-x-100_uti_gold.jpg" alt="Advertisement">

320-x-100_uti_gold.jpg" alt="Advertisement">