The rupee remained almost flat after initial volatility ahead of the Fed outcome - ICICI Direct

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

INR Futures

* The rupee remained almost flat after initial volatility ahead of the Fed outcome. The rupee depreciated almost 18 paise to close near 72.74 levels

* The US dollar slide as the Fed dampened early US rate hike view, which was contrary to market expectations. The dollar index continued to trade below 92 levels and ended near 91.5

Global Bonds

* The Nifty closed at the lowest point of the month as it had to face strong selling pressure. Even advance/ decline ratio was in favour of bears. According to option data, 14800 and 15000 Call option has noteworthy OI, which indicates that any rise in the Nifty would face strong resistance around this level

* The Bank Nifty, for a fourth continuous day closed in the red as it continued to witness persistent selling pressure. Both private and PSU banks closed near the lowest point of the day

FII & FPI Activities

* Foreign institutional investors (FII) remained net buyer to the tune of | 7871crore on March 16, 2021. They bought worth | 7257 crore in the equity market and bought worth | 813 crore in the debt market

Rupee Outlook and Strategy

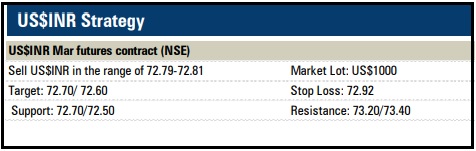

* The US$INR pair remained almost flat for the day after initial volatility. As the dollar index is sustaining below 92 levels, we feel the rupee is likely to appreciate towards 72.3 levels in coming days

* The dollar-rupee March contract on the NSE was at | 72.67 in the last session. The open interest fell almost 4.3% for the March series

US$INR Strategy

To Read Complete Report & Disclaimer Click Here

https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

Views express by all participants are for information & academic purpose only. Kindly read disclaimer before referring below views. Click Here For Disclaimer

Tag News

EURINR trading range for the day is 89.13 - 89.49. - Kedia Advisory

More News

The USD/INR futures pair has support at 76.30 levels whereas resistance is placed at 76.80 l...

320-x-100_uti_gold.jpg" alt="Advertisement">

320-x-100_uti_gold.jpg" alt="Advertisement">