The rupee may depreciate today on strong dollar and risk aversion in global markets - ICICI Direct

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

Rupee Outlook and Strategy

* US dollar increased 0.45% yesterday and climbed to a nine month high as FOMC meeting minutes signalled possibility of monetary tapering this year. Some officials saw potential to ease bond buying this year if the economy continues to improve as expected. Further, dollar gained strength on concern spreading of Delta variant may derail global economy

* Rupee future maturing on August 27 appreciated by 0.15% in Wednesday’s trading session on FII inflows and softening of crude oil prices. However, sharp gains was prevented on strong dollar

* The rupee may depreciate today on strong dollar and risk aversion in global markets. Market sentiments were hurt on concerns over spread of highly infectious delta variant, turmoil in Afghanistan and as FOMC meeting minutes signalled possibility of monetary tapering this year. Governments in AsiaPacific region are tightening restrictions on daily life and travel

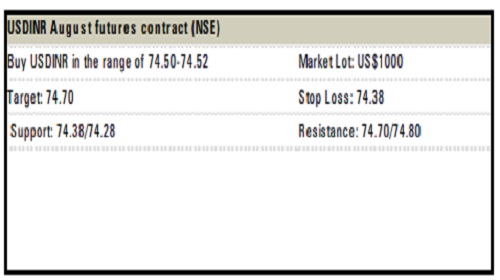

US$INR Strategy

To Read Complete Report & Disclaimer Click Here

https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

Views express by all participants are for information & academic purpose only. Kindly read disclaimer before referring below views. Click Here For Disclaimer

Tag News

EURINR trading range for the day is 89.13 - 89.49. - Kedia Advisory

320-x-100_uti_gold.jpg" alt="Advertisement">

320-x-100_uti_gold.jpg" alt="Advertisement">