The rupee is expected to trade with a negative bias on risk aversion in global markets and surge in crude oil price - ICICI Direct

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

Rupee Outlook and Strategy

US dollar increased 0.02% yesterday as it tried to recover from its drop after US Federal Reserve Chairman Powell indicated that central banks may start tapering their bond buying programme by year end but he was in no hurry to hike rates. However, further upside was capped on weaker-than-expected economic data

Rupee future maturing on September 28 appreciated by 0.48% in yesterday’s trading session on weakness in dollar, FII inflows and positive domestic markets

The rupee is expected to trade with a negative bias on risk aversion in global markets and surge in crude oil prices. Further, market participants will keep an eye on GDP data from the country to get clues on economic revival. Additionally, concern on uptick in daily Covid-19 cases in India may hurt the rupee. However, weakness in dollar may prevent a sharp fall in rupee

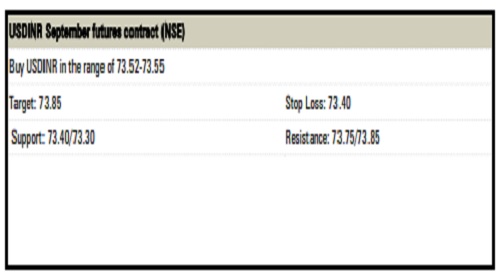

US$INR Strategy

To Read Complete Report & Disclaimer Click Here

https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

Views express by all participants are for information & academic purpose only. Kindly read disclaimer before referring below views. Click Here For Disclaimer

Tag News

EURINR trading range for the day is 89.13 - 89.49. - Kedia Advisory

More News

USDINR opened with a downward gap however buying momentum throughout the session led it to c...

320-x-100_uti_gold.jpg" alt="Advertisement">

320-x-100_uti_gold.jpg" alt="Advertisement">