The rupee is expected to depreciate today due to stronger dollar and higher FII fund outflows from domestic markets - ICICI Direct

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

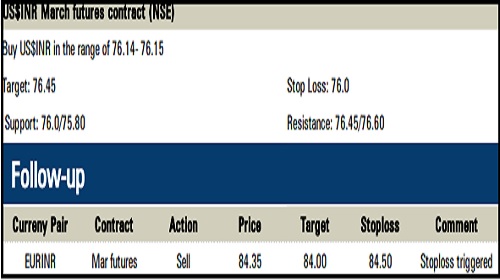

Rupee Outlook and Strategy

The dollar index advanced by 0.39% on Thursday after hawkish comments from US Federal Reserve Chair Powell. Moreover, risk aversion in global markets and improved initial jobless claims data from the US continued to support the dollar. However, a decline in US treasury yields capped further gains in the dollar

Rupee March futures depreciated by 0.30% on the back of elevated crude oil prices and sell-off in domestic markets

The rupee is expected to depreciate today due to stronger dollar and higher FII fund outflows from domestic markets. At the same time, pessimistic sentiments in global markets may weigh on the rupee. Additionally, investors will remain cautious ahead of a series of macroeconomic data from the US. US$INR (March) is likely to head further towards 76.50 for the day

To Read Complete Report & Disclaimer Click Here

https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

Above views are of the author and not of the website kindly read disclaimer

Top News

World wheat prices rise in July: FAO

Tag News

EURINR trading range for the day is 89.13 - 89.49. - Kedia Advisory

320-x-100_uti_gold.jpg" alt="Advertisement">

320-x-100_uti_gold.jpg" alt="Advertisement">