The rupee is expected to depreciate today amid strong dollar and persistent foreign fund outflows - ICICI Direct

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

Rupee Outlook and Strategy

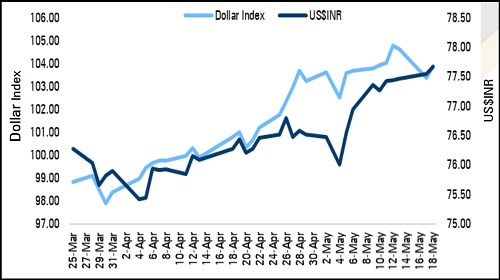

• The US dollar edged higher on Wednesday amid concerns about the outlook for global economic growth and hawkish statement from Federal Reserve Chair Jerome Powell. The Fed chair pledged that the US central bank would ratchet up interest rates as high as needed, including taking rates above neutral to kill a surge in inflation. However, sharp upside was capped on lower US treasury yields

• US$INR futures maturing on May 27 ended higher on Wednesday amid strong dollar and unabated foreign fund outflows

• The rupee is expected to depreciate today amid strong dollar and persistent foreign fund outflows. US$INR (May) broke a strong resistance level at | 77.65 and ended at | 77.68. We may see the pair approaching | 78.00 soon. We expect the rupee to depreciate further and trade in the range of | 77.50 to | 77.80

To Read Complete Report & Disclaimer Click Here

https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

Above views are of the author and not of the website kindly read disclaimer

Tag News

EURINR trading range for the day is 89.13 - 89.49. - Kedia Advisory

320-x-100_uti_gold.jpg" alt="Advertisement">

320-x-100_uti_gold.jpg" alt="Advertisement">