The rupee is expected to continue its positive bias amid a rise in risk appetite in global markets - ICICI Direct

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

Rupee Outlook and Strategy

• The US dollar advanced amid a surge in US treasury yields. Further, dollar demand rose on prospects of increased sanctions on Russia. Also, strong job data backed expectations of a half a percentage point rise in interest rates by the Fed at the May meeting

• Rupee future maturing on April 27 appreciated by 0.25% amid rise in risk appetite in the global markets and FII inflows. Further, rupee gained strength on softening of crude oil prices

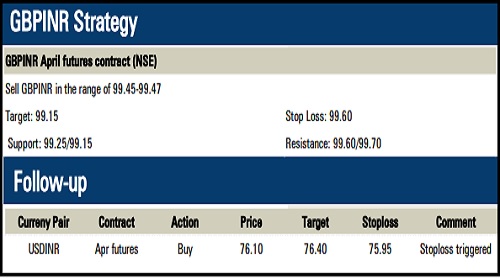

• The rupee is expected to continue its positive bias amid a rise in risk appetite in global markets. Further, FII inflows into local stocks will support the rupee. However, sharp gains may be capped on rise in crude oil prices and strong dollar. Furthermore, investors will track the war in Ukraine and will keep an eye on new reports of war crimes which may add pressure on US and European nations to further tighten sanctions on Russia. US$INR (April) is expected to trade in a range of 75.50-76.00

To Read Complete Report & Disclaimer Click Here

https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

Above views are of the author and not of the website kindly read disclaimer

Tag News

EURINR trading range for the day is 89.13 - 89.49. - Kedia Advisory

320-x-100_uti_gold.jpg" alt="Advertisement">

320-x-100_uti_gold.jpg" alt="Advertisement">