The rupee depreciated marginally and ended at 72.42 - ICICI Direct

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

INR Futures

* The rupee depreciated marginally and ended at 72.42 against the dollar despite recent dollar weakness as FII inflows have paused. US yields have moved up sharply towards 1.45 in the last session

* The Dollar index finally moved below 90 levels as fresh momentum was observed across risk assets post comments from the Fed. Euro has also moved to an almost two month high against the dollar

Global Bonds

* The Nifty extended its gains as positive global cues helped the market to open higher though later on it remained in the range of 100 points. According to option chain, 14900 and 15000 Put option has substantial OI, which should provide support in case of a fall while 15100 and 15200 Call option have significant OI, which should cap gains

* The Bank Nifty opened higher but later on profit booking was seen, especially in private bank

FII & FPI Activities

Foreign institutional investors (FII) turned net sellers to the tune of | 2031 crore on February 23, 2021. They sold worth | 300 crore in the equity market and sold worth | 1730 crore in the debt market

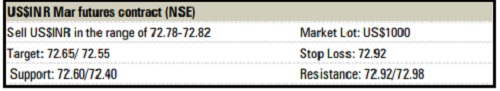

US$INR futures on NSE

* The US$INR March futures closed at 72.75 levels. However, considering the significant Call base at 73, we do not expect a major up move from current levels with upsides remaining shorting opportunities

* The dollar-rupee March contract on the NSE was at | 72.75 in the last session. The open interest increased almost 4% in the March series

US$INR Strategy

To Read Complete Report & Disclaimer Click Here

https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

Views express by all participants are for information & academic purpose only. Kindly read disclaimer before referring below views. Click Here For Disclaimer

Tag News

EURINR trading range for the day is 89.13 - 89.49. - Kedia Advisory

320-x-100_uti_gold.jpg" alt="Advertisement">

320-x-100_uti_gold.jpg" alt="Advertisement">