The rupee depreciated almost 1% after moving to a one-year high and closed at 73.46 levels - ICICI Direct

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

INR Futures

* A sharp sell-off was seen in most currencies as US bonds moved sharply. The rupee depreciated almost 1% after moving to a one-year high and closed at 73.46 levels

* The dollar index on Friday rallied to a one-week high. Weakness in EUR/US$ and strength in US$/JPY on Friday gave the dollar a boost. The dollar also extended its gains on better-than-expected US economic data

Global Bonds

* The Nifty opened significantly lower on account of weak global clues, followed by profit booking. Advance/decline ratio was in favour of bears

* On Friday, the Bank Nifty witnessed significant losses as it remained under pressure throughout the day. Relentless selling was seen in leading private as well as PSU banks

FII & FPI Activities

Foreign institutional investors (FII) turned net sellers to the tune of | 238 crore on February 24, 2021. They bought worth | 1790 crore in the equity market and sold worth | 2028 crore in the debt market

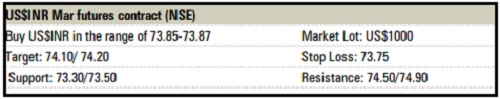

US$INR futures on NSE

* The US$INR March futures closed at 74.19 levels as a sharp up move was seen on the back of rising US yield and huge sell-off in domestic equities. We feel the rupee is likely to consolidate near 74 levels

* The dollar-rupee March contract on the NSE was at | 74.19 in the last session. The open interest increased almost 1.99% in the March series

US$INR Strategy

To Read Complete Report & Disclaimer Click Here

https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

Views express by all participants are for information & academic purpose only. Kindly read disclaimer before referring below views. Click Here For Disclaimer

Tag News

EURINR trading range for the day is 89.13 - 89.49. - Kedia Advisory

320-x-100_uti_gold.jpg" alt="Advertisement">

320-x-100_uti_gold.jpg" alt="Advertisement">