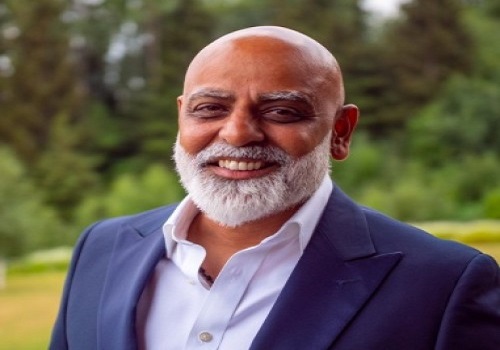

The investor will have to pay tax on the difference between the sale consideration and the adjusted cost of the units as per the prescribed formula Says Manoj Purohit ,BDO India

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

Below Quote On Pre Budget Corporate Tax By Manoj Purohit, Partner & Leader – Financial Services Tax, BDO India

"The tax proposal on certain distributions by REITs/INVITs and their mandatory characterisation as ‘Income from Other Sources' proposed in the Finance Bill 2023 has been one of the key tax proposals which has led to intended consequences such as denial of tax treaty benefits on capital gains in the case of certain non-resident investors. The amendment proposed to the Finance Bill has now diluted the impact by introducing a formula for calculation for such income to be distributed. By virtue of this, the potential tax exposure is mitigated on the amortisation of SPV debt if the total amount distributed does not exceed the issue price. The investor will have to pay tax on the difference between the sale consideration and the adjusted cost of the units as per the prescribed formula. The amount In excess of the original issue price of the units will be taxed as income from other sources at the maximum marginal rate. This is certainly a welcome proposal, allowing investors to breathe a sigh of relief as they would now be able to partly get out of the tax burden, especially to the extent of principal investment which has no income element".

Above views are of the author and not of the website kindly read disclaimer

.jpg)

Tag News

We anticipate immense potential benefits from the upcoming Sovereign Gold Bond Tranche in FY...

More News

Quote on Pre Budget Corporate Tax: There is high demand to have a relook at the corporate ta...