The index has support around 38000 - ICICI direct

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

Nifty

Technical Outlook

• The Nifty underwent healthy consolidation in the face of global volatility last week on expected lines cooling off from an overbought trajectory after a sharp 13% rally in July and early August. The price action resulted in a Bull candle as Monday’s large gap down attracted buying demand in the vicinity of 17200

• Going forward, we expect the Nifty to undergo healthy consolidation and gradually head towards 18300 in September while strong support exists at 16800, which we do not expect to be broken. We recommend to buy on dips to construct a portfolio of quality companies

• In the coming week, midcap and small caps are expected to relatively outperform while the Nifty undergoes healthy consolidation in the range of 17200-17800

• Key observations from last week are as follows:

• Nifty small cap index has given a conclusive breakout from eight month falling channel signalling end of corrective phase. Breakout is well supported by sequential improvement in market breadth as percentage of stocks above long term 200 day EMA rose from end July reading of 51% to 60% indicating broad based nature of rally

• Brent crude has given a breakdown below key support line since CY20 lows. We expect a decisive breach below $92 to accelerate downward momentum towards $86 in coming weeks

• Our structural positive stance is further validated by following observations: a) Nifty has given a breakout from falling channel of past eight months signalling end of corrective phase and resumption of uptrend, b) Nifty registered a bullish golden crossover in August (50-DEMA crossing above 200-DEMA) implying major shift of momentum in favour of the bulls from a medium term perspective. In last decade, in eight out of 10 such instances, the Nifty has generated average 11% return in subsequent three to four months

• Structurally, we expect BFSI, realty, auto, capital goods, PSU and consumption to relatively outperform

• Our preferred large caps are SBI, Kotak Bank, Asian Paints, Tata Consumer, M&M, L&T, DLF. while preferred midcaps are Bajaj Electricals, Supreme Industries, M&M Finance Jamna Auto, Lemon Tree, JK Lakshmi Cement, Ador Welding, Concor, Garden Reach Shipbuilder

• The prolonging of consolidation would make market healthy by cooling off overbought conditions (currently weekly stochastic cooled off to 73 from the previous week’s reading of 87). We retain the support base at 16800 as it is 50% retracement of July-August rally (15858-17992)

• In the coming session, index is likely to open on a flat to negative note amid mixed global cues. We expect the index to trade in a range with positive bias. Hence use intraday dips towards 17440-17475 for creating long position for the target of 17559

Nifty Bank

Technical Outlook

• The weekly price action formed a bull candle which mostly remained contained inside previous week price range signaling consolidation for the third week after the recent strong up move of 15 % in the preceding five weeks

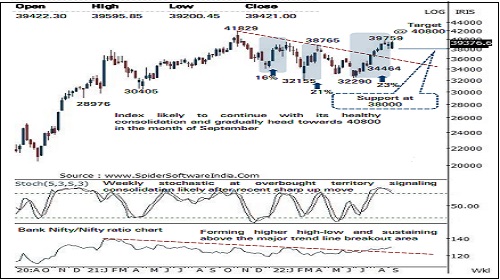

• Going ahead we expect the index to continue with its healthy consolidation and gradually head towards 40800 in the month of September . While in the coming week it is likely to consolidate in the broad range of 39800 -38000 with PSU banking stocks continue with its outperformance . Consequently, this will help the index to cool off overbought conditions (currently weekly stochastic cooled off to 82 from recent high of 95 )

• Structurally the recent rally from June lows of 32290 is strongest in magnitude terms since October 2021 while declines are smaller and short lived indicating an improving price structure . Hence, we view ongoing consolidation as healthy retracement that will make larger trend healthier and set stage for next leg of up move . Therefore, we recommend to use dips amid ongoing consolidation as incremental buying opportunity

• Bank Nifty continue to relatively outperformed the benchmark index in the last few quarters as can be seen in the Bank Nifty/Nifty ratio chart . Within the banking stocks PSU banking stocks has been resilient and showing relative strength which we expect to outperform going forward

• The index has support around 38000 levels as it is the confluence of the last two weeks almost identical low and the 38 . 2 % retracement of the previous major up move (34464 - 39759

To Read Complete Report & Disclaimer Click Here

Please refer disclaimer at https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

SEBI Registration number INZ000183631

Above views are of the author and not of the website kindly read disclaimer

Tag News

Stock Picks : TCS Ltd And Chambal Fertiliser Ltd By ICICI Direct

More News

The Markets are expected to open marginally higher today - Arete Securities