The index has managed to close above key support of 14400 - ICICI Direct

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

https://t.me/InvestmentGuruIndiacom

Download Telegram App before Joining the Channel

Index to consolidate with positive bias in upcoming truncated week…

Technical Outlook

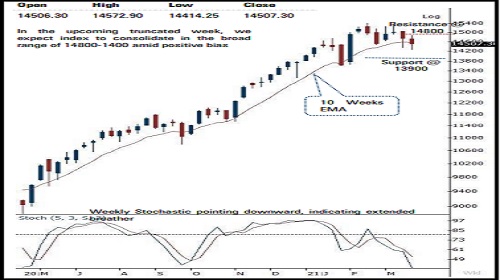

*The weekly price action formed a bear candle carrying lower highlow, indicating extended correction. Meanwhile, a lower shadow signifies supportive efforts emerged after retracing 61% of February rally (13597-15432), at 14300 which coincides with budget day gap area (14281-14469)

*Key point to highlight is that despite host of negative news around rising Covid-19 cases, the index has managed to close above key support of 14400 (on a weekly closing basis), indicating inherent strength. Since March 2020, Nifty has maintained a rhythm of not correcting for more than average 9% and time wise correction has not exceeded for more than 3 consecutive weeks. We expect this rhythm to be maintained. In current scenario, the Nifty has already corrected 7.5% from all time high of 15432. Therefore, price wise damage from hereon will be limited. Hence, any panic sell off from should be capitalised on to construct portfolio from medium term perspective. Meanwhile, 14800 would act as immediate resistance for the upcoming truncated week

*On the sectoral front, we expect IT, pharma, financials and FMCG to relatively outperform. On the stock front, in large cap space we remain constructive on TCS, Asian Paints, HUL, HDFC, Reliance Industries, Divis Laboratories along with FSL, Birla soft, Balkrishna Industries, Tata Chemical in midcaps

*Nifty midcap and small cap indices extended breather and approached the vicinity of their 50 days EMA coincided with upward sloping trend line, which has been held on multiple occasions since June 2020. Key point to highlight during recent correction is that, the Nifty midcap and small cap indices have maintained the rhythm of not correcting for more than 9-10% since March 2020. In the current scenario, both indices have corrected 9% while sustaining above 50 days EMA. • Structurally, we believe extended breather from here on would get anchored around key support zone of 14000-13900, as it is:

• a) 80% retracement of February rally (13597-15432), at 13964

• b) 9% correction from life high is placed around 14000

• c) 100 days EMA is placed at14000

*In the coming session, index is likely to witness gap up opening tracking positive global cues. We expect index to trade with a positive bias maintaining higher high-low formation. Hence, use intraday dip towards 14690-14715 to create long for target of 14799.

NSE Nifty Weekly Candlestick Chart

Nifty Bank: 33318

Technical Outlook

*The weekly price action formed a bear candle with a lower high -low signalling continuation of the corrective bias . It however carries a long lower shadow indicating a strong recovery from the previous major breakout area above the yearly high of CY 2019 & CY 2020 placed around 32500 levels .

*Going ahead , in the upcoming truncated week we expect the index to sustain above previous week low (32415 ) and witness pullback towards 34400 levels as it is the confluence of the previous week high and 50 % retracement of the last leg of decline (36497 -32415 ) .

*The last six weeks corrective decline has lead to the weekly stochastic placed at an oversold territory with a reading of 21 indicating an impending pullback in the coming weeks . However, the index require to start forming higher high -low in the daily chart on a sustained basis to signal a pause in the current corrective trend

*The major support for the index is currently placed at 32600 - 32400 levels being the confluence of the following technical observations :

a) 61 . 8 % retracement of the previous rally (29687 -37708 ) placed at 32750 levels

b) Major breakout area of previous multiple yearly highs placed around 32500 levels

*In the coming session, the index is likely to open gap up amid strong global cues . Volatility is expected to remain high . We expect the index to continue with its last Friday’s pullback as the weekly stochastic are at oversold territory . Hence, after a positive opening use intraday dips towards 33800 -33870 to create long position for target of 34090 , maintain a stoploss of 33690

Nifty Bank Index – Weekly Candlestick Chart

To Read Complete Report & Disclaimer Click Here

https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

Views express by all participants are for information & academic purpose only. Kindly read disclaimer before referring below views. Click Here For Disclaimer

Tag News

Stock Picks : TCS Ltd And Chambal Fertiliser Ltd By ICICI Direct