The dollar index slipped by 1.06% on Wednesday amid optimistic sentiments in financial markets - ICICI Direct

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

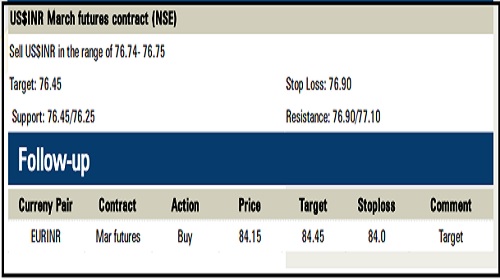

Rupee Outlook and Strategy

The dollar index slipped by 1.06% on Wednesday amid optimistic sentiments in financial markets. However, further downsides were cushioned on higher-than-expected JOLTs job openings data from the US

Rupee March futures appreciated by 0.41% on the back of muted crude oil prices and decline in dollar. However, continued FII funds outflows from domestic markets weighed on the rupee

The rupee is expected to appreciate today due to easing crude oil prices and softer dollar. Moreover, a rise in risk appetite in global markets may continue to support the rupee. However, expectations of higher consumer price reading from the US is expected to provide some support to the dollar. US$INR (March) is expected to move towards 76.25 for the day.

To Read Complete Report & Disclaimer Click Here

https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

Above views are of the author and not of the website kindly read disclaimer

Tag News

EURINR trading range for the day is 89.13 - 89.49. - Kedia Advisory

320-x-100_uti_gold.jpg" alt="Advertisement">

320-x-100_uti_gold.jpg" alt="Advertisement">